Visual: A cinematic visual of ocean waves in grayscale, with bold text: "SAMUDRA MANTHAN" and subtitle “Transforming India's Energy Landscape.”

[Music]

Visual: A grayscale map of the Indian Ocean region transitions to a zoomed-in view of India highlighting Kakinada, followed by ocean surface footage with foamy trails behind a vessel, dark underwater CG visuals showing depth layers—1 km below sea level, 2 km beneath the seabed. The visuals transitions to a several copies of a newspaper front page with the headline "Reliance Strikes Gas.”

Narrator: In the deep waters of the Bay of Bengal, 50 km off Kakinara in Andhra Pradesh on the east coast of India, nearly a kilometre below the sea level and then almost another 2 km below the seabed. Reliance had struck the world's largest gas discovery for that year.

Visual: An offshore drilling platform at sunset with flames burning on the right side; the text overlay reads 'July 2002 Reliance Discovers Gas.' Close-up views show flames burning from an offshore gas flare on the platform from different angles.

Narrator: In fact, in scale and size, it was the biggest find in almost 30 years. Knowing the gas was there was one thing. Getting it up and ready for the people of India was filled with multiple challenges, some known, many unknown.

Visual: Dark underwater seabed, aerial view of land plots with water channels labelled "2003 Land Acquisition," followed by stormy sea conditions, rough weather, and isolated ocean platforms under a moody, cloudy sky.

Narrator: It was an area with no known infrastructure to begin with. The conditions here were hostile for most part of the year.

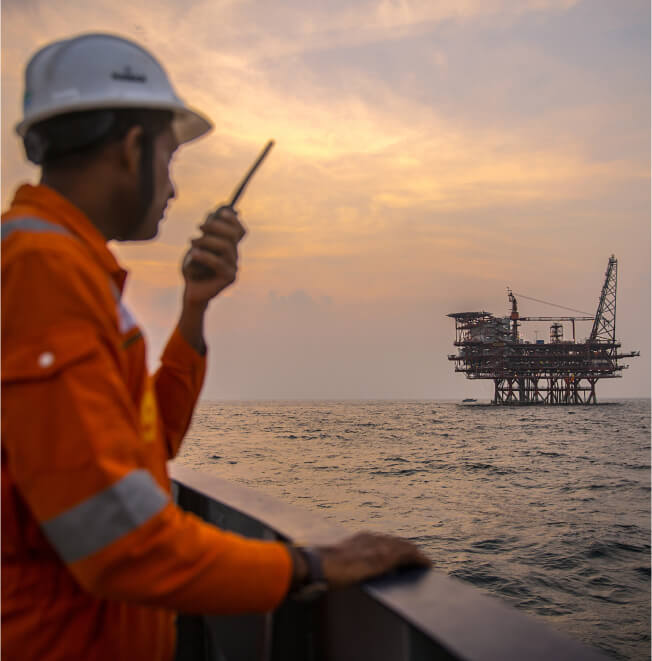

Visual: People working at computer stations monitoring offshore operations, alongside shots of equipment, underwater machinery, and personnel communicating on a ship’s bridge.

Narrator: There was an acute shortage of professionals, equipment, material, and services.

Visual: Sunlight reflects off the ocean surface, transitioning to underwater footage of deep-sea hydrothermal vents, then to people waiting at a busy urban crosswalk by day, and illuminated billboards and streetlights along a city road at night.

Narrator: Under normal conditions, according to global experts, it would be a good 10 years before the gas could be made available to the people of India. Given India's immediate energy needs, 10 years seemed like eternity.

Visual: A helicopter lands as a group of men, including M. Ambani and engineers wearing safety helmets, arrive and inspect a site, discussing plans and observing the area.

Narrator: Ready to shoulder the responsibility, Reliance picked up the gauntlet and set itself the target of delivering the gas in 6 year.

Visual: A man named P M S Prasad, Executive Director, is shown speaking from an office setting with maps in the background, followed by various scenes of M. Ambani and other employees wearing safety helmets interacting outdoors and walking inside an industrial setting.

P M S Prasad: A lot of people said at that point of time that what we were doing is too risky. We don't know, we are like babes in the wood, and you know this is not for the weak-hearted, etc etc. In fact, I remember his conviction became stronger. He said, “If everybody thinks it is difficult, we got to do it.”

Visual: The clock is shown ticking and moving across the screen from one side to the other, after which scenes of an offshore oil rig, a helicopter landing, workers in safety gear, meetings of professionals in various settings, a collage of two teams, and an aerial view of a coastline are shown.

[Clock ticking and waves sound]

Narrator: It was a race against time and the vagaries of the entire ecosystem. The best minds at Reliance were assigned to the challenging task. Two teams were set up exclusively for onshore and offshore. Offshore, there was a need for a highly sophisticated yet out-of-the-box solution.

Visual: Naresh Narang, Project Manager-Offshore, is speaking from an office setting, followed by a visual of a complex subsea infrastructure with interconnected yellow structures on the seabed.

Naresh Narang: We wanted a subsea architecture which could stand the rigors of harsh environment and work continuously and efficiently for the next 25 years or so.

Visual: A labelled schematic and wide-view layout of a complex subsea infrastructure with components like Manifolds, Well Heads, Jumpers, PLETs, and the D-W-PLEM unit, followed by visuals of close-up piping connections, 24-inch pipelines, a platform with CRP and Jacket, and red pipelines traversing underwater terrain to a coastal facility.

Narrator: Gas from a group of up to six wells would flow through a manifold. From six such manifolds to a deep-water pipeline end manifold, the DW PLM. The deep-water PLM weighs around 450 metric tons, almost as much as a Boeing 747. Then the gas would move up via two 24-inch pipelines to the CRP, the control and riser platform. From here, it would be transported to the shore via three 24-inch pipelines over a distance of 26 km through the Godavari River. The landfall point is where the gas pipes come up from below water level onto land for the first time and continue for another 5 km before reaching the onshore terminal.

Visual: The clock is shown ticking and moving across the screen and K S Rao, identified as Project Manager–Onshore, speaking in an indoor setting.

K S Rao: Onshore terminal houses the facilities where the gas produced from offshore is received, treated to make it suitable for transporting through a pipeline, and distribution to the consumers.

Visual: The clock is shown ticking and moving across the screen. Various shots of offshore drilling begin with a drillship. The text overlay reads: 'July 2005 Start Of Development Drilling.' This is followed by equipment deployment and crew operations, then 3D seismic visualizations used by engineers to analyse reservoirs and plan trajectories.

Narrator: In the Bay of Bengal, advanced rigs began drilling and completing development wells at water depths never before attempted in the Indian subcontinent to tap the gas reservoirs using the latest seismic techniques such as 3D high-resolution surveys and inversion studies for reservoir characterization.

Visual: The clock ticks as it moves across the screen. Scenes show a busy urban area with crowded streets, narrow roads, tangled overhead electrical wires, and pedestrians walking along a shop-lined street bustling with activity.

Narrator: Although the nearest port was just about 30 km away from the site, the access route was filled with obstacles: narrow roads, overhead cables, and densely populated areas along the way.

Visual: Shots of Reliance’s dedicated jetty at the landfall handling vessels, barges, and heavy equipment; the haul road connecting the jetty to the terminal; and security gates controlling access.

Narrator: Reliance constructed a dedicated jetty for material movement at the landfall point. This jetty was capable of providing berth to vessels and barges, bringing in the largest of skids and equipment. Then a 10-meter-wide, 5 km long dedicated road was specially constructed between the jetty and the onshore terminal site for quick and easy transportation of unloaded consignments.

Visual: Workers handling heavy equipment, performing welding and pipe fitting, working night shifts, collaborating on-site, operating cranes to lift materials, with safety signage displayed.

Narrator: The new challenge for the onshore team was to find skilled hands to work during a construction boom time in India. Getting skilled labour at a remote location with restricted social contact and peak summer temperatures hitting 45°C proved to be the bigger challenge. People-friendly Reliance policies managed not only to motivate workmen to join but also retain them.

Visual: The clock is shown ticking and moving across the screen. Workers fabricating specialized offshore equipment, including large pipes, metal frameworks, control panels, and jackets, collaborate indoors and outdoors to prepare for dispatch to the offshore site.

Narrator: Elsewhere across the world, fabrication of specialized offshore equipment was going on in full swing. Everything had to be ready for dispatch to the offshore site in India on time—Christmas trees, manifolds, even the CRP and its jacket.

Visual: The clock is shown ticking and moving across the screen. Ships and vessels at sea, including a large ship with a helipad, a vessel carrying offshore equipment, and another ship labelled "HELIX" loaded with industrial machinery.

Narrator: Offshore, a fleet of specialized construction barges and vessels was employed to put all the equipment into place—the largest fleet ever deployed in India at a single offshore location. Each vessel was designed to tackle a specific phase of the installation.

Visual: The clock ticks across the screen. A couple of shots of a construction yard showing steel structures being fabricated with workers and cranes, the text overlay reads: "2007 Completion of CRP Jacket Fabrication.

Narrator: Across the seas, the CRP was steadily taking final shape.

Visual: A large completed steel jacket structure is transported on water with a person nearby, followed by a dockyard with industrial equipment and structures being prepared for shipment, then an offshore platform on water labelled "Completion of CRP Topside, Fabrication & Load Out, 2008," and finally the steel jacket structure being floated or towed offshore.

[Music]

Visual: A large steel jacket is transported on a barge, slid into shallow waters, then lifted and upended by a tall crane, with workers and support vessels present during the offshore installation.

Narrator: Once at the point of installation, without much ado, the jacket was made to slide off the barge onto the shallow seabed. Then one of the world's tallest cranes, the DD101, moved into action to lift and upend the jacket. The task was achieved with precision, speed, and dexterity to make the gigantic CRP stand tall and erect like a metallic man-made island.

Visual: Underwater seabed, an ROV at work. The text overlay reads: 'Installation of Subsea Structures – 2008.' Large yellow manifolds are being installed onto suction-anchored foundations positioned offshore."

Narrator: Further offshore, several large diameter pipes were strategically suction-anchored into place. These mammoth, almost invisible columns would now provide a permanent foundation to the enormous heavy-duty subsea structures such as manifolds.

Visual: Control panel with switches and buttons, text: "JULY 2008 D-W-PLEM Installation," yellow industrial structure, machinery with cables, text: "JULY 2008 Christmas Tree Installation," workers handling equipment, text: "JULY 2008 Start Of Subsea Umbilicals Installation," and yellow mechanical arm showing key components and steps in installing manifolds.

Narrator: One by one the manifolds were put in place, as were the Christmas trees. All the deep-sea installations get their power from the umbilicals. The umbilicals are the true lifelines of the entire system.

Visual: Person monitoring screens, and underwater animations showing "JULY 2009 Jumper Installation," jumper connections between subsea structures, and diagrams of jumpers linking manifolds to pipeline ends.

Narrator: Below the sea, the ROVs were hard at work with the last-mile connections—connecting the jumpers to hook up the manifolds as well as the Christmas trees with the well flow lines.

Visual: The clock ticks across the screen; a man at a computer, another group working on computers beside a yellow piping system, text: "JULY 2009 Pre Startup Checks Of OT, CRP & Subsea Facility," and a group of workers in helmets smiling in front of yellow industrial equipment.

Narrator: Now it was time to check the entire system thoroughly for leaks and gas tightness, together with the overall integrity of the entire system. The 1st of April 2009 was a day of reckoning at Reliance.

Visual: Workers smiling and operating a control panel. Flame burning in the sky, text: "JULY 2009 Commencement Of Gas Production From B1 Well, “ and a wide shot of industrial area with towers and pipelines.

Narrator: The main valve was thrown open. Gas, the life-giving energy for India, began to flow with all systems working as envisaged. This was a textbook startup.

Visual: M. Ambani speaking at a podium with images and text behind him showing Reliance facilities and operations.

M. Ambani: It will place Reliance well on the path to be a global energy major and India well on the road to energy security.

Visual: Various shots of an industrial set-up with a blue sign labelled “Auxiliary Substation.” A modern control room with large digital displays and multiple workstations, and an industrial facility transitioning from sunset to night with increasing illumination.

Narrator: The largest and the most complex deep-sea greenfield project in a single location—built in a record time of about six and a half years. Everyone at Reliance and every Indian will take pride in the knowledge that India had indeed done it.

Visual: A brightly lit industrial facility at night, a close-up of an offshore platform with red structures and equipment, a wide view of the same offshore platform standing alone in the ocean, and the video ends with the Reliance Industries Limited logo with the “Growth is Life” tagline.

[Music]