Fiscal prudence and proactive risk management formed the guide rails for navigating a challenging macro environment. Despite synchronised raising of policy rates by Central Banks and volatility in commodity prices, we contained the rise in finance costs while ensuring the Balance Sheet has strength and liquidity to support growth initiatives.

Alok

Agarwal

Srikanth Venkatachar

Soumyo

Dutta

Anshuman

Thakur

Dinesh

Taluja

Saurabh

Sancheti

C. S. Borar

Raj

Mullick

Sumit

Mantri

Global Economy

Global economy grew 3.4% in CY22, slowing from the post-COVID rebound of 6.2% in CY21. Growth was in-line with pre-pandemic average (2015- 19) of 3.4% despite Russia-Ukraine conflict and aggressive rate hikes by central banks. Advanced economies (AEs) saw above-trend growth of 2.7% in CY22, higher than the 2.1% average seen in the five years prior to the pandemic. This was led by strong growth in both US and Euro area which grew at 2.1% % and 3.5% respectively. Inflationary pressures remained near multi-decade highs in AEs, with US inflation averaging 8% Y-o-Y (highest since 1980s), while Euro area inflation also averaged a multi-decade high of 8.4%. Developed market central banks aggressively tightened their monetary policy to address inflation, with US Federal Reserve raising rates by 450bps in CY22, while European Central Bank hiked rates by 250 bps. Emerging Market and Developing Economies (EMDEs) grew 4% in CY22, below the pre-pandemic average of 4.4% due to slowdown in Chinese economy amidst frequent lockdowns. China growth eased to 3%, well below the pre-pandemic average of 6.7% on continued zero-COVID policy and housing downturn. Crude oil prices were elevated during FY 2023, averaging $93/bbl, remaining above $100/bbl in first half of the fiscal year due to

Russia-Ukraine conflict, but receding in the second half with Chinese demand slowing and release of strategic petroleum reserves from OECD countries.

Global growth is expected to slow in CY23 to 2.8% as the lagged impact of synchronised global monetary tightening. Growth in advanced economies is expected to decelerate to 1.3%, with US and Euro area growth expected at 1.6% and 0.8% respectively. Effect of rapid rate hikes over last one year as well as emerging credit crunch risks from US regional banks remain key concerns for advanced economies. Emerging markets growth is expected to hold near pre-pandemic average at ~3.9% in CY23, supported by India and China. China growth is expected to rebound to 5.2% in CY23 from 3% on reopening of the economy after three years and continued monetary policy support. India is expected to remain amongst the fastest growing economies as per IMF.

Indian Economy

The Indian economy remained relatively stable amidst the global imbalances caused by the RussiaUkraine conflict. The economy grew at 7.2% in FY 2022-23, down from 9.1% in FY 2021-22, as per the National Statistical Office data release.

The spike in global commodity prices pushed up prices in India too, with retail inflation peaking at 7.79% in April 2022, above the medium-term target band of 2%-6% of the RBI. The RBI took stringent measures to combat the rising prices, hiking repo rate six times in FY 2022-23, from 4% at the beginning of May 2022 to 6.5% at the close of the financial year. Private consumption, however, witnessed a strong surge fuelling a boost in production across sectors. Domestic sector services activity remained resilient with average Services PMI higher at 57.5 in FY23 vs 52.2 in FY22. Manufacturing too remained robust with average manufacturing PMI higher at 55.8 in FY23 vs 54.1 in FY22. Credit growth gained traction with year-on-year growth of 15% (as of March ’23) while deposit growth lagged with year-on-year growth of 9.6%, leading to a rise in incremental credit-deposit ratio.

India overtook Japan and Germany to become the third largest automobile market in terms sales in December 2022. India also emerged as the second largest mobile phone manufacturer globally. India’s digital adoption continues in an accelerated way. UPI payments continued their impressive run in FY 2022-23, with transaction volumes almost doubling from ~45 billion in FY 2021-22 to ~84 billion in FY 2022-23, while transaction value also surged to ~139 lakh crore in FY 2022-23 from ~84 lakh crore in FY 2021-22. The pan- India monthly mobile data traffic stood at 14.4 Exabyte in 2022 with 3.2x growth over last five years. Rapid digitisation supported by solid infrastructure is driving efficiency and productivity in the economy. India’s external sector continued to gain strength as FY23 merchandise exports grew to $447 billion, growing at 6% Y-o-Y and services exports grew to $322 billion, growing at 27% Y-o-Y.

Global supply chain improvements and falling commodity prices coupled with softening domestic demand are likely to moderate inflation to 5.1% in the current financial year. With a growing working age population, a large domestic market, boost to infrastructure development and advent of digitisation, India is well positioned to be the fastest growing large economy in the world. India GDP is expected to grow at 6.5% in FY24.

Performance Overview

Reliance delivered strong annual performance amid macro headwinds caused by geo-political conflicts, disruptions in commodity trade flows and economic downturn. Resilience of Reliance’s strategic and operational capabilities reflected in its ability to adapt to dynamic business environments and navigate through complex business situations. Growth was supported by agile and efficient operations by all business teams with sound strategic planning and implementation.

Earnings growth was led by rebound in O2C business, backed by healthy domestic demand, strong fuel margins and high utilisation rates. Oil and gas segment performance reflected volume growth in KG D6 gas production, higher gas price realisations and margin improvements. Operational efficiencies continued with 100% uptime.

Consumer business segments continued to strengthen their positions in the market with aggressive expansion of footprint and strategically prudent acquisitions. Jio successfully launched True 5G services across over 2,300 towns and cities, thereby continuing to offer enhanced digital experiences to its subscribers. The retail business broadened its product and distribution base further, making available a vast assortment of products and brands to its consumers at affordable prices.

Reliance Jio Financial Services is demerged. The new entity is expected to unlock value for shareholders and give them an opportunity to be a part of a new growth platform.

The New Energy business is making rapid progress with fast paced implementation of the giga factories at Jamnagar. With strategic partnerships and significant investments in newer technologies, Reliance is well on track for building the New Energy business as a strong sustainable growth engine and achieving the target of becoming Net Carbon Zero.

`0,0 CRORE

CONSOLIDATED REVENUE IN FY 2022-23 ↗ 23.6% Y-O-Y

Revenue

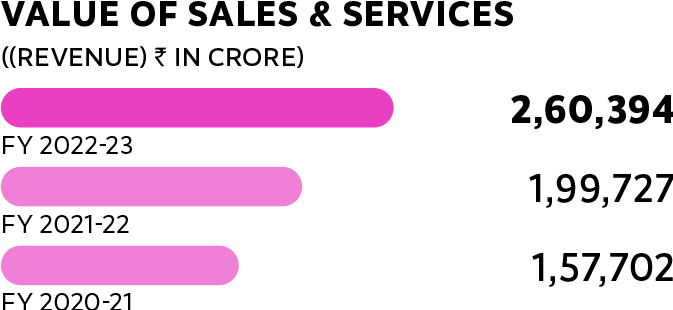

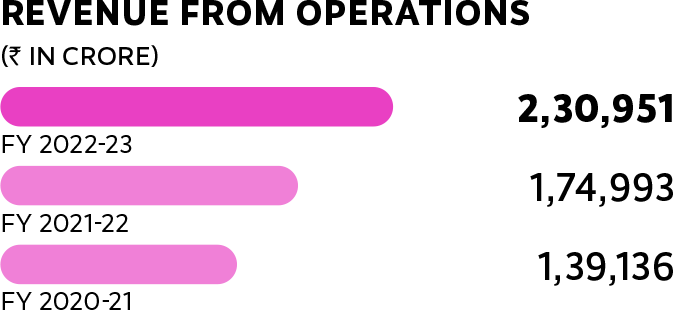

Reliance attained a consolidated revenue of `9,74,864 crore ($118.6 billion), up 23.6%, as compared to `7,88,743 crore in the previous year. All operating segments saw growth in revenue. O2C revenues increased on account of improved price realisation for transportation fuels with 19% increase in average Brent crude prices. Sharp increase in gas price realisation coupled with increase in the gas production contributed to growth in Oil & Gas segment revenues. Retail Segment revenue was driven by strong broad-based growth across all consumption baskets and large-scale store expansion. Digital Services revenue was led by full impact of tariff hike, ramp-up of wireline services and continued subscriber addition for mobility services.

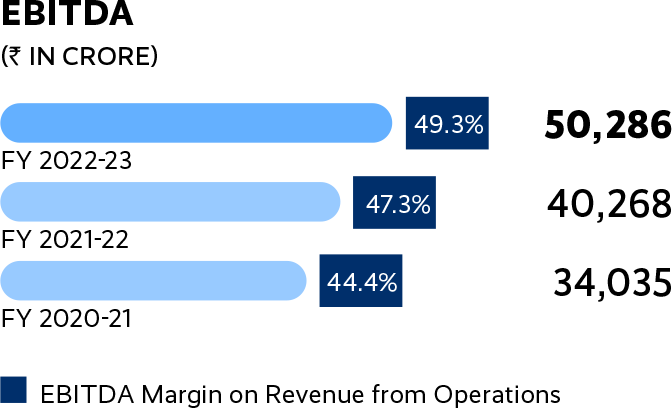

Profit

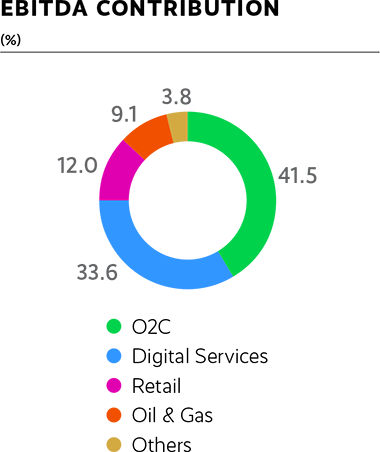

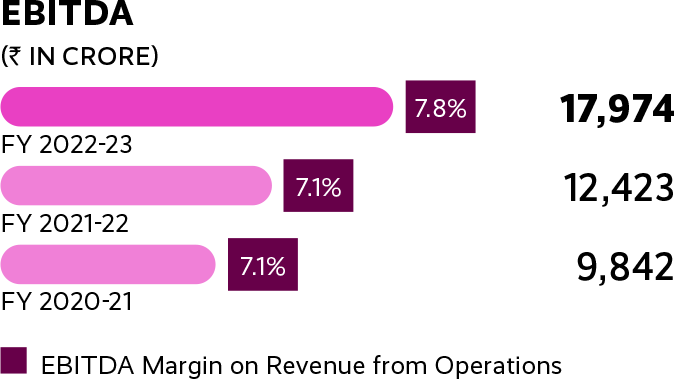

Consolidated EBITDA for the year increased by 24.4% to `1,53,920 crore ($18.7 billion) as compared to `1,23,684 crore in FY 2021-22. Retail business led EBITDA growth with 44.7% increase mainly due to benefits of scale and operating leverage leading to margin expansion. Growth in Digital Services segment EBITDA was 24.9% on account of higher revenue and steady improvement in margins. O2C EBITDA increased by 17.7% with sharp improvement in transportation fuel cracks and robust demand which was partially offset by introduction of SAED on export of transportation fuel and lower downstream product delta. Oil & Gas segment EBITDA increased over 2.5x with higher gas price realisation. Cash Profit increased by 15.4% to `1,25,951 crore as compared to `1,09,099 crore in the previous year. Profit After Tax was higher by 11.3% at `73,670 crore.

Gross Debt

Reliance’s Gross Debt was at `3,13,966 crore ($38.2 billion). This includes Standalone gross debt of `2,15,823 crore and balance in key subsidiaries, including Reliance Retail ( `46,644 crore), Reliance Jio ( `36,801 crore), Independent Media Trust Group ( `5,815 crore) and Reliance Sibur Elastomers ( `2,144 crore).

Standalone

RIL’s Standalone revenue for FY 2022-23 was `5,65,347 crore ($68.8 billion), an increase of 21.6% as compared to `4,65,045 crore in the previous year. Revenue growth was led by increase in crude and product prices. Profit After Tax was at `43,017 crore ($5.2 billion) an increase of 13.4% against `37,937 crore in the previous year. Basic EPS on Standalone basis for the year was `63.6 as against `57.5 in the previous year.

Movement in Key Financial Ratios

- The debt service coverage ratio improved to 2.03 in FY 2022-23 as against 1.19 in the previous year due to improved earnings and lower principal repayments during the year.

- The trade receivable turnover ratio declined to 36.13 in FY 2022-23 as against 50.13 in previous year due to improving terms of trade with tightening of global fuel markets and increased economic activity.

- The return on capital employed improved to 20.6 in FY 2022-23 as against 14.5% in previous year due to higher operating profit led by strong growth in earnings from oil & gas business and improved profitability of the O2C business.

- The return on net worth improved to 10.9% in FY 2022-23 as against 10.1% in previous year due to increase in net profit during the year with positive contribution from all key operating segments.

`0 CRORE

PROFIT AFTER TAX

IN FY 2022-23 ↗ 13.4% Y-O-Y

Segment Review

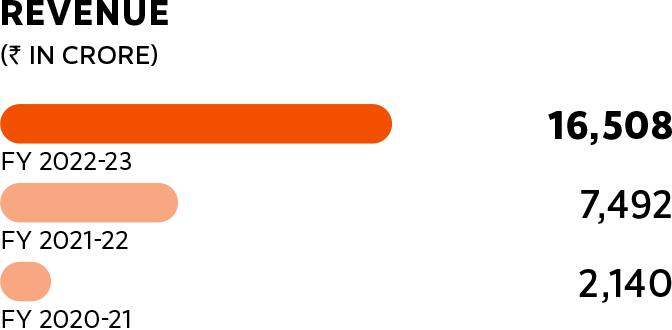

Retail

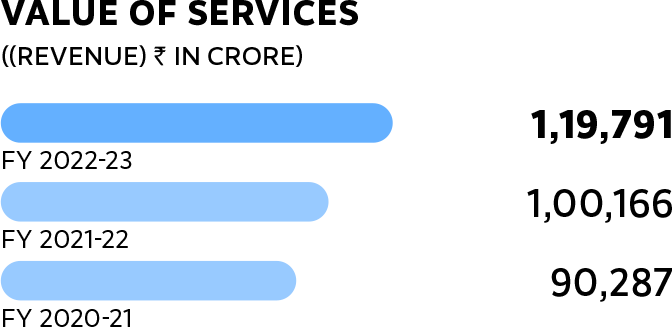

Performance Update

- EBITDA margin was at 7.8%, up 70 bps Y-o-Y driven by favourable mix, sourcing benefits and operating efficiencies.

- Digital Commerce and New Commerce businesses contributed to 18% of revenue in FY 2022-23.

- The registered customer base grew to 249 million, a growth of 29% Y-o-Y.

- The business crossed the milestone of 1 billion transactions in FY 2022-23, up 42% Y-o-Y. Stores recorded footfalls of over 780 million, which were up 50% Y-o-Y.

Strategic Update

With focus on store network expansion, the business grew its store footprint across consumption baskets. This year the business opened over 3,300 new stores, taking total count to 18,040 stores with a total area of 65.6 million sq ft. The business added 25 million sq ft store area during the year, representing more than 50% growth of retail space Y-o-Y. Investments in boosting supply chain infrastructure remained a priority to deepen warehousing and fulfilment capabilities, with addition of 12.6 million sq ft of warehouse space during the year.

The retail segment continued to innovate, launch and scale up new retail formats to serve diverse customer segments. New format launches during the year included Smart Bazaar, Azorte, Centro, Fashion Factory and Portico.

The business also added new growth initiatives to its portfolio by foraying into FMCG and Beauty businesses. The FMCG business launched several products during the year including ‘Independence’ brand and the iconic beverage brand, ‘Campa’. The beauty business launched digital commerce platform ‘Tira’ and opened its flagship store in Mumbai. These businesses will be ramped up progressively in the coming period.

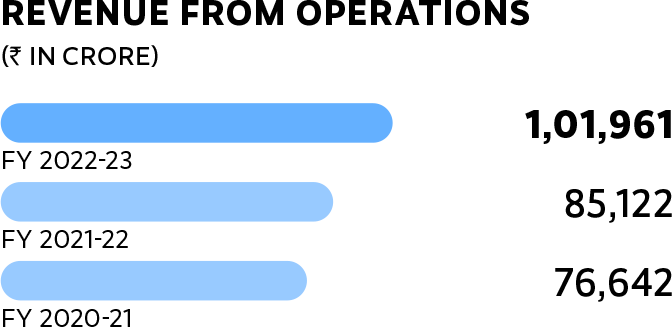

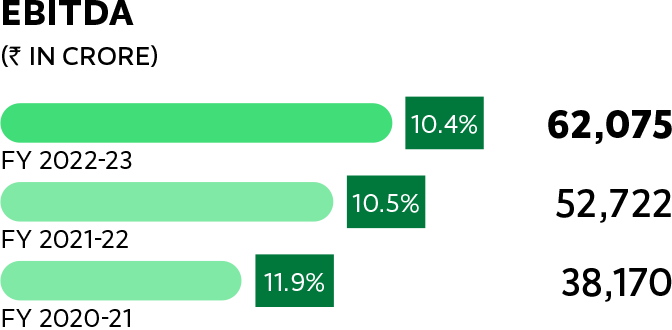

Digital Services

Performance Update

- Jio’s industry leading net subscriber addition was 29.2 million for FY 2022-23 with monthly churn remaining stable at ~2%

- ARPU increased 6.7% Y-o-Y in quarter ending March 2023 due to impact of tariff hike, better subscriber mix and data add-ons.

- Jio network carried 113.3 Exabyte of data on its network (+24 % Y-o-Y). Jio continues to carry >55% of data traffic in the country.

- Healthy subscriber additions across mobility and homes, improvement in ARPU and scale-up of digital services drives JPL consolidated revenue growth.

Strategic Update

Jio extended the coverage of its True5G services to over 2,300 cities/ towns across India. Jio users in these cities are invited to experience unlimited data at up to 1 Gbps+ speeds, under the Jio Welcome offer. ~60K 5G sites across 700MHz and 3500MHz bands are already deployed and the pan-India rollout is on track to be completed by December 2023.

Introduction of the new home broadband “Back-up Plan” will help expand the broadband market. Jio also introduced a new set of postpaid family plans – ‘Jio Plus’ bringing the benefits of high-quality True 5G connectivity to the masses.

JPL powered the technology behind streaming of FIFA World Cup, the first ever Women’s Premier League and the 16th Indian Premier League garnering unprecedented viewership.

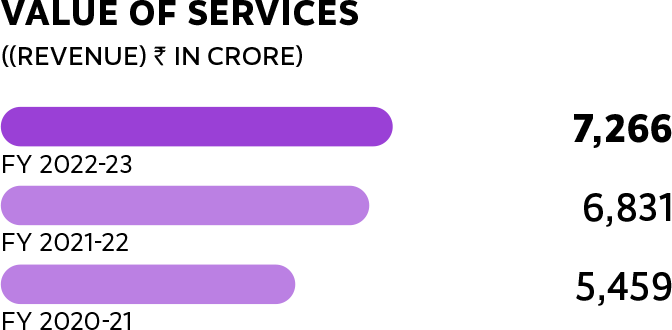

Media Business

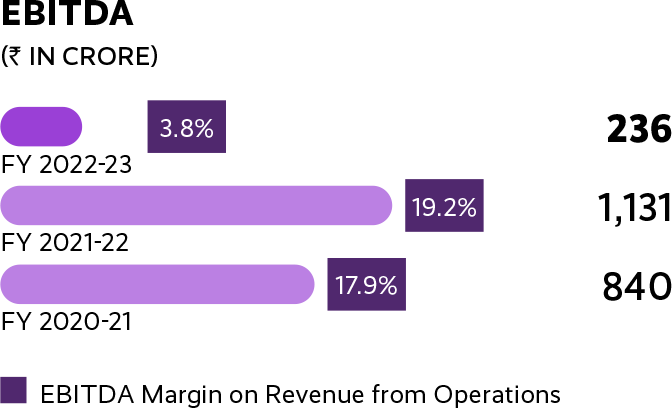

Performance Update

- The business navigated through a difficult revenue environment and economic headwinds to deliver highest-ever operating revenue.

- Advertising revenue was impacted by the economic slowdown and high inflation which constrained advertising budgets of companies across sectors. Withdrawal of Colors Rishtey from DD FreeDish, the FreeTo-Air platform, also affected the advertising revenue.

- The business made investments in growth verticals – Sports and Digital, which also had an impact on profitability.

- Sports segment made a grand debut with IPL, FIFA World Cup and Women’s Premier League, establishing itself as the leading destination for premium sports content.

- Colors consolidated its #2 position in the Hindi GEC space, TV News network’s channels rose to leadership status in key markets and Digital News portfolio continued to be India’s #2 online news publisher, and Movie production segment delivered a strong slate of movies.

Strategic Update

Viacom18 entered into a strategic partnership with Reliance, Bodhi Tree Systems and Paramount Global, to lead innovation and disruption in the Indian M&E space and create one of the largest TV and digital streaming companies in the country.

Oil to Chemicals (O2C)

Performance Update

- The EBITDA was highest ever for the segment despite the impact of SAED of `6,648 crore.

- Revenue was driven by improved transportation fuel cracks, feedstock sourcing flexibility, ethane cracking advantages and better average fuel prices globally.

- Crude oil prices rose sharply with Brent price averaging $96.2/bbl

- FY 2022-23 witnessed a rise in demand for transportation fuels with increase in travel and normalisation of economic activities.

- Domestic demand for oil, polymers and polyesters showed a strong growth. Lower product realisation led to decline in polymer deltas by 15% - 32% on Y-o-Y basis. Domestic downstream chemicals demand was strong with highest ever domestic sales for polymers even though global demand remained soft.

- SAED levy on transportation fuels impacted earnings adversely.

Strategic Update

During the year, Reliance Polyester Limited, the company’s wholly owned subsidiary acquired the polyester business segment of Shubhalakshami Polyester Limited and Shubhlaxmi Polytex Limited. Together along with ACRE Ltd., Reliance completed the acquisition of Sintex Industries Ltd.

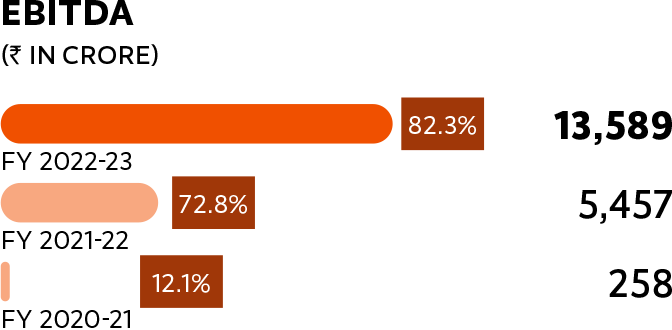

Oil and Gas E&P

Performance Update

- EBITDA grew 2.5x driven by increased production and improved realisation

- Gas price realisation improved to $10.6/MMBTU from $4.92/ MMBTU last year in KG D6 block. The CBM block saw increase in price realisations to $21.63/MMBTU from $6.82/MMBTU in FY 2021-22. Production (RIL share) was 175.3 BCFe for FY 2022-23.

- Domestic production in FY 2022-23 was at 10-year high with increased production volumes in the KG D6 block.

- This year witnessed 100% uptime in operations and zero safety incident.

Strategic Update

Production from the MJ field commenced in

1Q FY 2023-24. The KG D6 gas will account for approximately 30% of India’s domestic gas production at its peak capacity of ~30 MMSCMD and will cater to key sectors like CGD, power, fertiliser, refiners, steel, glass, and ceramics among others.

Liquidity and Capital Resources

Persistent Inflationary pressures and globally rising interest rate environment were the key underlying themes of financial markets in FY 2022-23. The year was also marked by a sharp depreciation of the Rupee against the Dollar. RIL successfully managed its Balance Sheet risks through the challenging environment while ensuring sufficient liquidity for business operations.

External Environment

A persistent broadening of inflation pressures triggered a rapid and synchronised tightening of global monetary conditions, alongside strong appreciation of the US dollar against most other currencies.

The rising price pressures were expected to produce a squeeze on real incomes as well as undermine macroeconomic stability. This led most Central Banks around the world to rapidly lift nominal policy rates to much above the pre-pandemic levels, both in advanced and emerging market economies. The US Federal Reserve raised policy rates aggressively by 500 bps in past fifteen months, the fastest hiking cycle since 1980. In Europe, the war-related intensification of inflationary pressures led European Central Bank to finally exit its negative interest rate regime and ultra-easy monetary policy after eight years and raise interest rates by 325 bps in past nine months. The real activity and financial markets responded to the removal of monetary accommodation with slowing momentum in housing market, credit conditions, labour markets and PMI surveys.

In response to progressive rate hikes by the Central Banks, the global headline inflation started declining in the second half of the year. However, the decline in inflation print reflects the sharp reversal in energy and food prices and the core inflation continues to remain sticky. Consequently, to anchor inflation expectations major central banks have signalled the need for staying course on a restrictive monetary policy stance.

On the other side, the accelerated policy normalisation has brought forth vulnerabilities in the US regional banks. The risk of contagion across the broader financial sector is inducing volatility in the financial markets and driving market-implied policy path on downside.

RBI too raised rates by a cumulative 250 bps in the year, in-line with global monetary tightening as inflation remained persistently above RBI’s 6% upper-target band. As the forward outlook on inflation moderated towards 5-5.5% in the second half of the year, RBI guided for a conditional pause keeping the policy stance focused on withdrawal of accommodation. A prolonged pause from RBI is expected to progressively align headline inflation to its target while also supporting growth.

On the external front, a noticeable improvement in India’s current account deficit (CAD) on back of moderation in oil prices and structural strength in India’s services exports, is expected to keep CAD benign and below 2% of GDP. The outlook on capital inflows also looks promising as emerging markets growth is expected to outperform developed markets. As the lagged effect of cumulative hikes sets-in, developed markets is expected to witness slowdown. In contrast, India is expected to emerge as the fastest growing economy in FY 2023-24 with 6.5%, while global growth are expected only at 2.8%. Overall, India’s growth differential and comfortable CAD dynamics are expected to keep the Indian Rupee well supported in the near to medium-term.

Despite the unprecedented macro-economic uncertainty, the Company was successfully able to navigate abrupt adjustments in the market, maintain adequate liquidity on its balance sheet, manage its financial market risks and deliver a consistent return on its investment portfolio by staying invested in low risk, liquid instruments. Reliance Treasury continued to stay focused on providing liquidity to the businesses at the optimal risk adjusted cost by accessing financing from different markets and using appropriate instruments and currencies.

Treasury Management and Financial Strategy

Reliance’s medium term Financial Strategy is guided by a Financial Planning process which is integrated with individual business plans. RIL Treasury’s key objectives include raising Long Term financing for capex and Short-Term liabilities for financing working capital at the most efficient rates and also design suitable hedging strategies to manage currency and interest rate risks on both the asset and liability side of company’s Balance Sheet.

Fund Raising

During FY 2022-23, the Company and its subsidiary Reliance Jio Infocomm Limited (RJIL) tied up $3 billion equivalent through syndicated term loan facilities. The transaction was heavily oversubscribed in the primary syndication market by global lenders across geographies. The proceeds from the loans were used to meet the capital expenditure requirements of both the companies. This was a landmark transaction on various counts:

- The aggregate liquidity raised from primary syndication was $3 billion equivalent, one of the largest liquidity raised through syndication in Asia Pacific (APAC).

- 55 international lenders across all major continents participated in the transaction making it the largest bank group in a corporate loan out of APAC since 2000.

- This is the largest syndicated loan from India

RJIL tied up its first ever Swedish Export Credit Agency (EKN) supported facilities of $2.2 billion equivalent making it the largest cover ever provided by EKN for a deal to a private corporate globally.

The proceeds of the facilities shall be utilised to finance the equipment and services in relation to RJIL’s pan-India 5G roll out.

Liquidity Management

The combination of strong cash flows from operations, access to unutilised borrowing facilities, and robust cash and cash equivalents position forms the basis of Reliance Industries’ liquidity base. This strong liquidity position provides the company with financial flexibility, enabling it to navigate various market conditions, pursue growth opportunities, and meet its financial obligations effectively.

The operating cycle is closely monitored to optimise the working capital structure and facilitate short term financing. Our proactive approach to reviewing trade financing solutions and optimising the operating cycle demonstrates our commitment to robust working capital management and effective business financing. RIL effectively uses Commercial Paper, Working Capital Demand Loan and other solutions to finance its payables and receivables and reduce the cost of funds.

RIL manages its cash and cash equivalents through an investment portfolio, diversified across instruments and counterparties. The investments are in highly liquid instruments such as government bonds, AAA papers, Bank deposits and Debt Mutual Funds. The investment portfolio is monitored under a strong risk management framework assuring adherence to liquidity objectives. The portfolio is calibrated continually to straddle between the objectives of capital protection, steady returns, and provision of adequate liquidity at short notice.

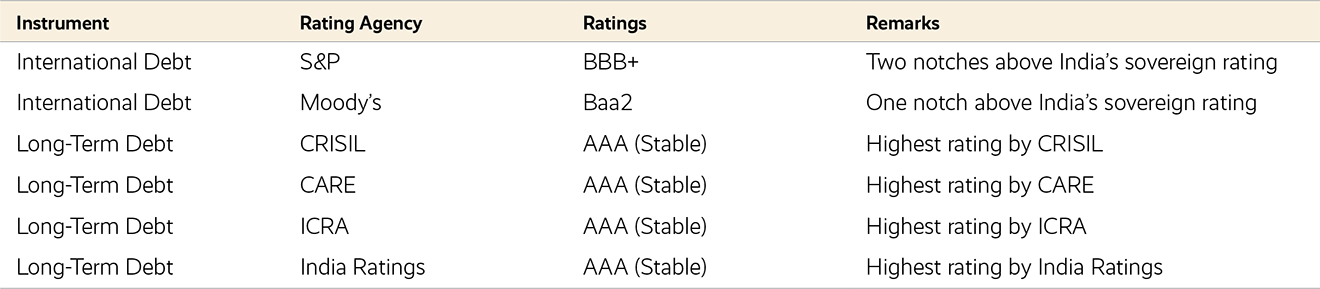

Credit Rating

RILs focussed approach on financial discipline and risk management is reflected in its strong credit rating as it continues to be rated two notches above sovereign by S&P and one notch above sovereign by Moody’s.

Awards and Accolades

In FY 2022-23, RIL won the much-coveted IFR Asia Award for ‘Investment Grade Bond’ for the $4 billion multi-tranche Senior Unsecured Notes issued in January 2022.

Way Forward

RIL will continue to draw strength from its robust balance sheet and operating cash flows to create value for its shareholders in a sustainable manner by investing in new business opportunities. RIL will continue to monitor financial markets for the right opportunity to raise capital to support growth plans of existing and new businesses while maintaining a keen focus on financial discipline and risk management.