FINANCIAL METRICS

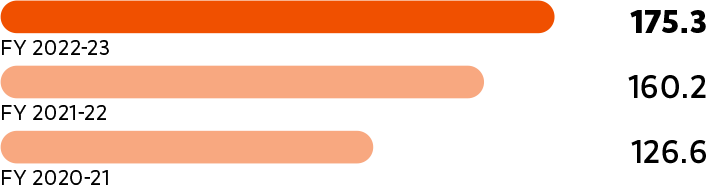

REVENUE

(` crore)

![]() 23.6%

23.6%

`0,0 CRORE

Strong revenue growth led by high energy prices and robust growth in consumer businesses.

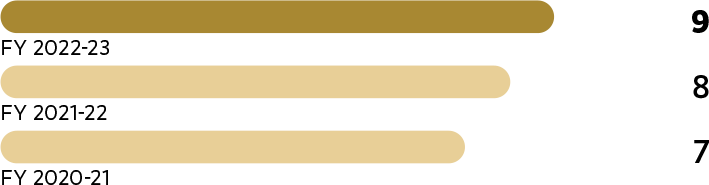

EARNINGS PER SHARE

(`)

![]() 9.5%

9.5%

`0

Strong operating performance with all businesses contributing to earnings growth.

NET WORTH

(` crore)

![]() 3.7%

3.7%

`0,0 CRORE

Higher retained earnings led to Y-o-Y increase in net worth.

DEBT EQUITY RATIO

0.

The debt to equity ratio impacted by higher debt mainly due to working capital and translation impact on foreign currency liabilities.

PROFIT AFTER TAX

(` crore)

![]() 11.3%

11.3%

`0 CRORE

Record net profit led by strong operating performance partially offset by higher finance cost, depreciation and taxes.

DIVIDEND PER SHARE

(`)

![]() 12.5%

12.5%

`0

Consistent track record of increasing dividend year on year.

BOOK VALUE PER SHARE

(`)

![]() 8.2%

8.2%

`0

Decrease in book value per share due to demerger of Financial Services undertaking.

CONTRIBUTION TO NATIONAL

EXCHEQUER

(` crore)

`0,0 CRORE

RIL retained its position as one of the India’s largest taxpayer and also the leading contributor of customs and excise duty in the private sector.

MARKET CAPITALISATION

(` crore)

`0,0 CRORE

Note: Market Capitalisation as on July 20, 2023, ex-demerger of financial services undertaking post price discovery thereof is `17,72,456 crore

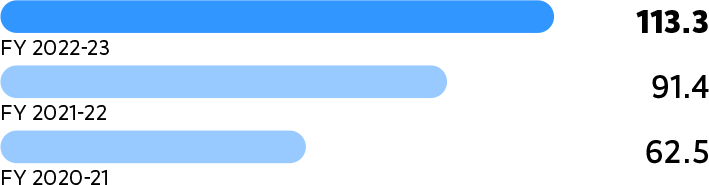

REGISTERED CUSTOMER BASE

RELIANCE RETAIL

(million)

![]() 29%

29%

0 MILLION

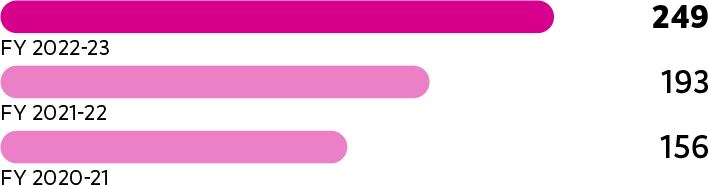

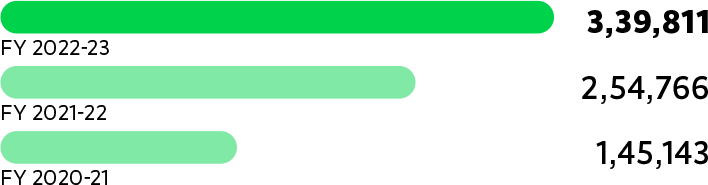

DATA TRAFFIC

(billion GBs)

![]() 24%

24%

0 BILLION GBs

O2C EXPORTS

(` crore)

![]() 33.4%

33.4%

` 0,0 CRORE

METRICS

METRICS

NUMBER OF PATENTS GRANTED

0

HSE EXPENDITURE

(` crore)

`0CRORE

CUMULATIVE REACH OF RELIANCE FOUNDATION

(crore people)

0 CRORE (NO. OF PEOPLE)

PERSON-HOURS OF TRAINING IMPARTED

(crore)

0+ CRORE

OIL AND GAS

DOMESTIC PRODUCTION

(BCFe)

0 BCFe