Reliance Risk Management Framework provides consistent, clear and robust framework for managing risks across the group and thus is fundamental to our performance and progress as a company.

WE CARE is the one common, unifying thread that runs through everything we do at Reliance. At Reliance, we are continuously working to deliver a sustainable future along with stakeholders. Reliance’s integrated risk management helps the group in management of risks at both strategic and operational levels and enables achievement of short and long term business outcomes. It ensures a safe and compliant operating environment, aligned to our values and behaviours.

Nikhil R.

Meswani

Hital R.

Meswani

Srikanth

Venkatachari

Laxmidas V.

Merchant

Harish

Shah

K. R. Raja

Enterprise Risk Management (ERM) at Reliance

Ever-changing dynamics of risk environment has made it inevitable for every organisation to have a robust risk management process in place to address multi-dimensional risks proactively in holistic manner.

The Company’s Risk Management Framework follows the below mentioned risk assessment process and thus allows the management to:

- Identify specific risks and assess the overall potential exposure

- Decide how best to deal with those risks to manage overall exposure

- Allocate resources and actively manage those risks

- Obtain assurance over effectiveness of the management of risks and reporting

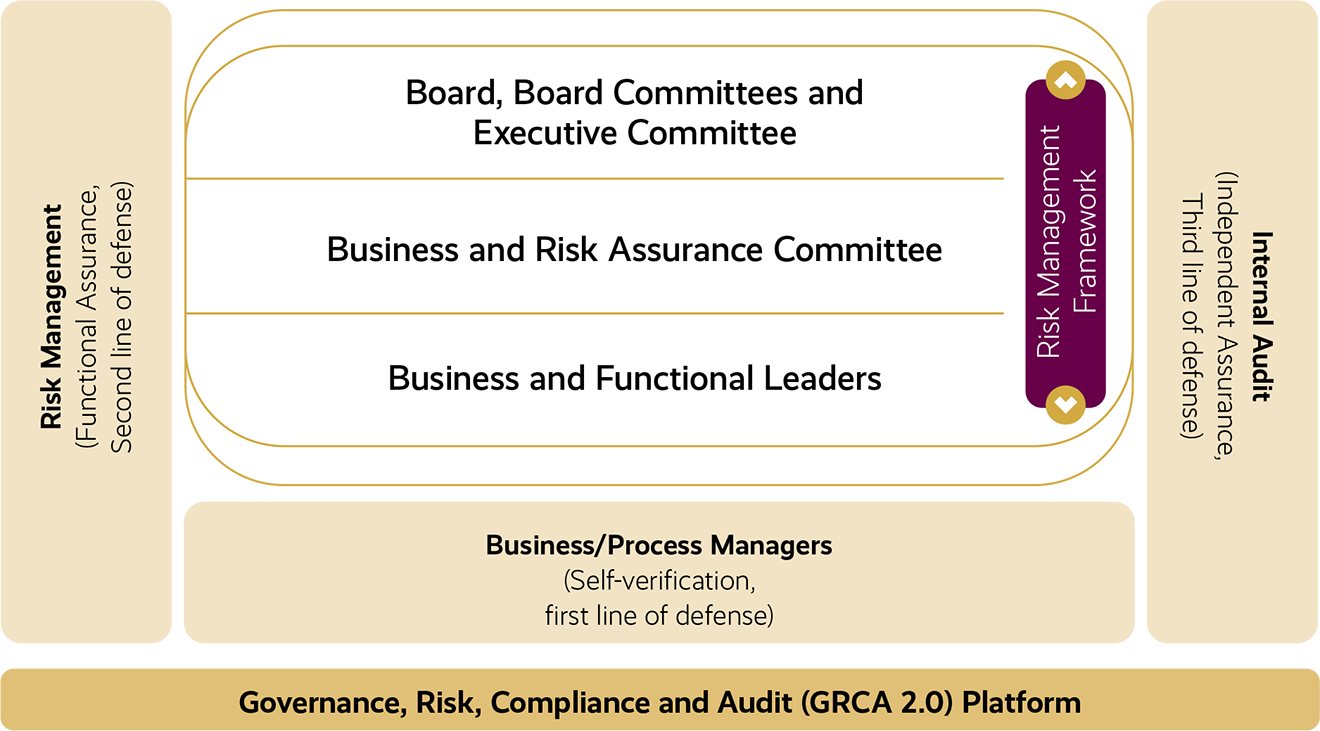

Governance Framework

Reliance’s Risk Management Framework is designed to be end-to-end framework for managing and reporting risks from the Group’s operations to the Board. The Board provides oversight through various Risk and Executive Committees as below:

RISK MANAGEMENT

Further, the company has effectively advanced to ERM 2.0. GRCA platform enables real-time monitoring of risks and controls across three lines of defense. Basis the risk heat map, the minimum levels of oversight, review, escalation and endorsement are adopted from process manager level to the leadership level.

Executive Committee provides oversight and governance through Group Operational Risk Committee, Group Financial Risk Committee, Group Audit & Disclosure Committee, Group Compliance Committee and Group People Committee. For understanding the Company’s corporate governance and functioning of the Board and details on Internal Controls, please refer to the Board’s Report and Corporate Governance Report.

Business Risk and Assurance Committees (BRACs) are headed by Business, Function and Group leadership which meets on a periodic basis for management of Business and Strategic Risks.

Business and Functional Leaders ensure safe and reliable incident-free daily operations through identification, mitigation and monitoring of existing and new risks on day to day basis through weekly meetings consisting of all three lines of defense (LOD).

Strategic and

Commercial Risks

Safety and

Operational Risks

Compliance and

Control Risks

Financial

Risks

Natural Capital

Human Capital

Manufactured Capital

Intellectual Capital

Social and Relationship Capital

Financial Capital

RISKS AND RESPONSE

Strategic and Commercial Risks

Climate Change and Energy Transition

Impact on:  , all businesses

, all businesses

Risk Description

Climate change continues to feature in the top 10 global risks cited by the Global Risk Report 2023. Global warming is having a compounding effect on the climate system, resulting in increased humanitarian challenges and further straining already stretched fiscal balances.

For businesses, climate change risks manifests in two broader categories, namely physical and transition risks, as outlined by global frameworks. Physical risks refer to the potential impacts on a company caused by both short-term extreme weather events (acute) and long-term changes in climate patterns (chronic). On the other hand, transition risks pertain to the potential hazards businesses may face as the world transitions to a lower-carbon energy system which includes risks due to policy changes, legal action, technological advancements, shifts in supply and demand, and changes in stakeholder attitudes.

Physical Risk

Throughout the year, an array of climate change induced weather events was experienced around the globe and in India too. These calamities included extreme weather events like intense heatwaves, cyclones, erratic rainfall, floods, and others, affecting almost every region of the country and causing unprecedented levels of destruction. Having a wide geographical spread, the organisation is susceptible to such erratic weather phenomenon which could cause disruptions in its operations and supply chains, in addition to causing negative impact on the wellbeing of our people and our assets.

Additionally, long term changes in climate patterns causing rising temperatures and sea levels may also expose our operations to future impacts of worsening climate change, which can impact our business continuity in certain vulnerable regions.

Risk Response

Reliance has robust business continuity management plans to manage risks arising from the physical impacts of climate change events. Each business segment after thorough evaluation of risks and its impact, develops these plans to ensure uninterrupted availability or swift recovery of essential business processes, resources and operations. Regular review and testing are undertaken to ensure the effectiveness

The Global Corporate Security (GCS) team focuses on adopting pre-emptive, de-risking strategies to safeguard and secure operations from disasters, natural calamities, and any other disruptions or incidents at RIL. Digital Services has established an integrated process for Disaster Recovery and Emergency Response to ensure network functionality and uninterrupted customer services. Retail has also developed comprehensive plans for disaster recovery and incident response to guarantee business continuity during any potential disruptions or incidents.

Transition Risk

Risks Related to Policies, Law and Regulations

Driven by ongoing geopolitical tensions and the urgency to act on climate change, a new global energy order is emerging - leading to a shift in the way energy is produced and consumed. This gradual move away from fossil fuels is prompting an increased focus on developing policies, incentives and regulatory frameworks that can bolster the adoption of low-carbon technologies and green products - which may impact the demand for RIL’s current products. Additionally, the envisaged development of a domestic carbon market regime and thereby the likely introduction of stricter regulations related to GHG emissions may impact RIL’s operating costs.

Risk Response

Reliance continues to focus on energy management and resource optimisation to reduce its carbon footprint through adoption of data analytics, advanced process controls and optimisation models. It is proactively shifting its dependence on fossil fuels to renewable alternatives like solar, biomass etc. to meet its captive energy demand. The Company also has plans to establish 20 GW of solar energy generation capacity by 2025, which will be consumed for captive round-theclock (RTC) power and will also serve as intermittent energy for Green Hydrogen production.

Reliance is committed to scaling up responsible consumption practices and maximising circularity across its value chain through sustained investments in R&D of innovative technologies and solutions. By keeping resources in use for longer, our circular business models can help to reduce the demand for new raw materials and the associated carbon emissions from their extraction, transportation and processing. These initiatives are enabling us to minimise our impact on the environment and thereby mitigate the regulatory risks that may arise from a high carbon liability.

Market Risk

With the increasing number of customers embracing clean energy and materials, the demand for conventional products is likely to reduce, which may potentially impact the company’s revenue and profits.

Risk Response

The Company has integrated climate-related issues into its strategic planning, investment reviews, risk management processes, and long-range supply and demand forecasts. As reflected in its adoption of a long-term perspective on the transition to green energy, Reliance has set a bold and forward-looking vision to establish itself as a leading global player in the New Energy and New Materials industry. The company’s 15-year plan entails a multi-pronged approach to creating sustainable energy sources and futuristic materials for India’s future, while advancing the development of cutting-edge technologies to convert CO2 emissions into useful products, use CO2 as feedstock and develop next-gen carbon capture and storage technologies, in line with its focus on sustainability and innovation

With a plan to invest around `75,000 crore over a span of 3 years, Reliance aims to:

- Establish and enable 100 GW of solar energy by 2030.

- Build five Giga factories namely the integrated solar photovoltaic module factory, an advanced energy storage battery factory, an electrolyser factory, a fuel cell factory, and a power electronics factory, thereby creating an integrated, end-to-end renewable energy ecosystem.

- Partner with leading companies globally in Solar, Battery, and Electrolyser space.

- Focus on bioenergy, offshore wind, and other non-conventional sources.

- Maximise crude to chemicals integration and create a portfolio of advanced and speciality materials.

- Transform RIL’s business into Net Carbon Zero operations.

Once proven at scale, RIL is prepared to double the investment to scale up its manufacturing ecosystem.

In addition, Reliance is also engaging in R&D initiatives and taking concrete measures to enable transformation in its value chain. For instance, RIL along with Ashok Leyland developed this unique technology of India’s first Hydrogen Internal Combustion Engine (H2-ICE) powered heavy duty truck.

Through these strategic initiatives, RIL aims to not only mitigate the negative impacts of climate change, but also position itself as a reputable leader in green energy business. The company’s green energy transition underscores its commitment to address evolving customer demands for a sustainable future, as well as its dedication to responsible corporate citizenship.

Technology Risks

As Reliance is shifting to explore newer business avenues in cleaner technologies, there are inherent risks and costs for scaling up novel technologies to their full potential.

Risk Response

Reliance is leveraging the expertise and experience of its New Energy Council (NEC), a group of leading global technocrats and thought leaders, to accelerate its transition to clean energy. NEC is enabling creation of a strong foundation to realise our vision of New Energy business – its strategic advice on innovative technologies and partnerships will help us mitigate the risks posed in these novel areas.

Reputational Risk

Growing concerns about climate change and increased momentum towards Net Carbon Zero could result in higher expectations from society and investors to address the environmental impact. Failure to meet these expectations could lead to damage to the company’s reputation, which could impact RIL’s ability to access capital, as well as to attract and retain talent.

Risk Response

Reliance is closely monitoring the progress of its Net Carbon Zero by 2035 target including realisation of its near-term targets. We have set interim timelines for significant milestones across various initiatives within the New Energy business. A dedicated ESG committee has been instituted at the group level to facilitate supervision over the implementation and review of crucial initiatives, with the aim of ensuring progress towards the attainment of our Net Carbon Zero goals.

Further, the company recognises the significance of effective stakeholder engagement, particularly in relation to its climate change goals and believes that ongoing dialogue with its stakeholders is essential to ensure alignment with the company’s objectives for a sustainable future.

With focus on research and technological innovation, strong fundamentals and deep understanding and knowledge of chemistry and materials that adds to our competitive edge. Reliance is well positioned to manage, risks while creating opportunities in the coming decades.

Commodity Prices and Markets

Impact on:  , Oil to Chemicals & Retail business

, Oil to Chemicals & Retail business

Risk Description

The Russia Ukraine conflict and consequent US and EU sanctions on Russian crude oil, product and natural gas exports have the potential for creating shortages of crude oil and products and driving up prices. This can impact the availability of crude oil and cause a spike in price of feedstock.

The high energy inflation could lead to headwinds for the global economy affecting oil demand and refining margins.

There was unforeseen market scenario with a disruption of energy sources and oil supply mainly in the western regions due to geo-political developments between neighbouring countries of Ukraine and Russia. This has resulted in a shift in sourcing of energy and oil from alternate destinations, which has led to change in the trade-flows worldwide.

The resultant longer sea passage has created shortage of availability of tankers and thus historically high volatility in freight rates.

Further, the phased embargoes of Russian products that has come into place has created challenges which are likely to continue to be more complex for transportation of food and energy worldwide.

Non availability of goods at right price, quality and quantity can adversely affect our retail business. There are several variables that may impact procurement decisions such as stock limits imposed by Government, adverse monsoon which may impact commodity prices, international geo-political events such as Russia – Ukraine war.

Risk Response

RIL’s strategy has been to source feedstocks from diverse sources to ensure supply security. Accordingly, RIL has long term contracts with various Middle East National Oil Companies, African and Latin American countries. It has also entered into term contracts with Canadian companies to source heavy crude oil.

Reliance has a robust ship tanker fleet, which is suitable to trade worldwide. This set of time charter ships was optimally and proactively utilised along with ships from the spot markets achieving smooth and timely cargo evacuation and by limiting exposure to freight cost.

The liquid tanker shipping markets has never seen such demand before. The challenge was to find suitable ships at commercially viable cost. This was managed by tight monitoring of the time charter ships multiple scheduling until the last minute for the best and optimum route for the time charter ships, while ensuring nil downtime (100% utilisation) basis ship and cargo availability and at the same time fulfilling the contractual commitment to the customers.

Minute planning and close coordination between the teams of Business, Operations and Chartering achieved this complex task.

Reliance Retail undertakes a detailed analysis of the macro-economic situation and proactively maintains and tracks market intelligence on geopolitical/economic policies shaping up in the global market. Continuous interactions and engagement with different stakeholders like brokers, traders and monitoring commodity exchange trades gives business the right impetus to carefully plan and de-risk itself against the external factors. We have internal controls and processes to ensure we procure optimum quantities at competitive prices in the market and also have wide base of vendors across geographies for each of the goods we procure.

Customer Experience and Retention

Impact on:  , All Businesses

, All Businesses

Risk Description

Digital Services being a customer oriented business, any sub-optimal customer experience may result in customer dissatisfaction and increased chances of churn.

Evolving habits and changing customer preferences could weaken our value proposition and in turn could lead to low loyalty and repeat purchases from customers.

Reliance Retail could lose customers or incur liability for any injuries suffered by customers which can impact our reputation and financial performance.

Competition from other oil marketing companies poses risk of customer retention as the country is surplus in petroleum products. Certain sanctions and embargoes on export of petroleum products to some countries may also pose a risk.

Risk Response

For sustained customer experience at Digital business, following measures are adopted:

- Superior usage and billing experience

- Anytime, anywhere mobile and wireline broadband network access

- Best-in-class customer service backed by technologies like AI, Bots and app based QRC (Query Resolution Complaints) process

- Competitive tariff pricing

- Agile service model adopted to develop systems and platforms

- Enhancing customer experience with localised support

- Structured process of measuring Customer Satisfaction (CSAT) across all touchpoints.

Customer engagement remains robust with strong gross additions of subscribers, significant increase in net MNP subscribers and increase in per capita data usage. The Company has also invested in newer technologies start-up’s such as AI / ML, Blockchain, BoT, Speech / NLP, Metaverse, Mobility & 5G network, Robotics, Cloud & Edge computing etc. Use of these technologies will further enhance customer experience and value proposition.

Reliance Retail remains abreast on the trends in consumer preferences taking place in Indian and global markets. Its deep consumer understanding helps in designing and developing trendy and relevant products to cater to the dynamic needs of its consumers.

Reliance Retail is consumer centric organisation and has adopted a stringent policy of taking cognisance of ‘CUSTOMER SAFETY’ as topmost value and priority. Rigorous quality checks and all safety norms are adhered to at all times.

On the customer complaints front, the business has placed a dedicated ‘Customer Service’ team that handles all queries routed through emails, voice calls, chats, social media etc. This has ensured faster resolutions and enabled retention of our end consumers.

Ensuring timely deliveries, quality assurance, efficient logistic solutions, pricing options, etc. at competitive prices reduce the risk of customer loss in oil to chemicals business. Diversified customer profile across various geographical regions provides alternative markets for our products thereby reducing risks arising from sanctions.

Oversight over Investee Companies/Alliances

Impact on:

, all businesses

, all businesses

Risk Description

Strategic alliances formed with various other business entities to expand Reliance businesses could have an adverse impact on our financial performance and our competitive position. Inadequate oversight over Investee companies or challenges in successful integration could also result in significant higher costs to its business.

Risk Response

Aligning investee companies in a structured manner to the group has been high priority for Reliance. We focus on strong governance processes and internal controls including integrating the financial systems and operational processes. The investee companies are brought under the Reliance Risk Management Framework, which provides a holistic view to formulate Annual Operating Plans that integrates across various businesses and functions.

Talent to Support Scaling Business

Impact on:  , all businesses

, all businesses

Risk Description

The ability to attract people, develop and retain talent is one of most critical factors for enabling smooth operations within our business. Given the scale and breadth of our operations, retaining talented personnel is imperative and a source of competitive advantage for the business.

Risk Response

Reliance has always adopted a forward-looking approach and has always treated its people with equal opportunities, thereby taking care of its people needs and retaining them by providing them fast paced growth opportunities.

Constant training and skilling initiatives along with a rigorous development regime empowers our businesses to have the right set of people at the right place and at the right time.

Focus to continuously build a strong talent pipeline by having an elaborate succession planning from critical roles to leadership roles is already in place and the business is well positioned to meet all its people demands in the near future.

Data Privacy Risk

Impact on:  , all businesses

, all businesses

Risk Description

Data has undoubtedly become a key pillar in this digital economy where every interaction results in generation of massive datasets. This data is consumed and used by businesses for providing customised experiences, helping shape new business models and driving a customer-centric service environment in this competitive market. This also brings challenges to organisations in ethically handling such data. The rising number of data breaches is the greatest concern for organisations of every size and scale.

Due to the large-scale digitisation and expansion of B2C businesses, the handling of personal data of customers, consumers, employees, partners, and service providers transparently and securely becomes of utmost importance. Improper handling and inadequate data protection practices may lead to data breaches and non-compliance with laws and regulations.

Risk Response

Reliance recognises the importance of Data privacy and safeguarding personal data is one of the top priorities at Reliance. Data privacy principles are followed across the lifecycle of personal data to address data privacy risks.

Reliance ensures all its business processes follow the privacy-by-design and privacy-by-default approach and makes sure that the personal data is used ethically and legally. Adequate control measures are implemented for the protection of the personal data of individuals collected, processed, and stored by RIL.

Data Privacy processes are formalised across all businesses. Data Privacy Impact Assessments are conducted for all business processes that are involved in handling data. Transfer or sharing of personal data is controlled through Personal Data sharing processes. Data Privacy Awareness and training are conducted periodically to make users aware of best practices while handling individual’s personal data.

Reliance always strives to stay ahead of the compliance curve. Although compliance with the existing laws and regulations is demonstrated, global best practices are being adopted to comply with laws applicable to any jurisdiction or geography in which we operate going forward.

Cybersecurity Risk

Impact on:  , all businesses

, all businesses

Risk Description

RIL has always been at the forefront of using cutting-edge technologies for bringing more efficiency into businesses. Digital transformation is thus an ongoing activity in Reliance. The pace of digital transformation has been increasing over the years. One of the consequences of such rapid digital transformation is the expansion of cyber-attack surfaces. Cybersecurity risk is thus emerging as one of the prominent business risks.

Cybercrime and Cyber Insecurity is considered as one of the severe global risks as per the World Economic Forum’s Global Risk Report 2023 making it clear that cyber risks will remain a constant and significant concern over the next decade. Cyber Attacks today are more sophisticated, persistent, and disruptive in nature. Geo-political influences are magnifying the risks to critical infrastructure. Adversaries are leveraging emerging technologies such as AI etc. to initiate cyber-attacks on organisations that typically evade the existing defenses.

Risk Response

Reliance has adopted an approach of being proactive and at the same time being resilient to manage cyber risk. The Cyber Security strategy defined at Reliance is based on Mark to Threat and is aligned to business as well as technology.

Security by design principle and shift left strategy is followed across the lifecycle of the digital platforms to ensure that cyber security controls are part of the design. The cyber-attack surface is continuously monitored to identify vulnerabilities or misconfigurations and identified weaknesses are fixed on priority.

Contemporary and state-of-the-art security technologies and processes are deployed for protection against emerging attacks at multiple layers. Intelligence-driven Cyber Defense operations are performed for proactive threat detection. Rapid response playbooks are in place and updated regularly for cyber incident management.

Third-party risk management processes are in place to manage and minimise the impact of supply chain attacks.

At RIL, special attention is paid to Cyber Security awareness and to foster a culture of Cyber security as humans have turned out to be the best defenses to combat cyber threats. Innovative solutions such as R-phish are deployed to improve user awareness levels by tracking their Phishing Resistance Score levels.

Cybersecurity awareness month is observed every year with a context-based campaign. The context for this year was “Fostering a culture of cyber security”. During this month we have also released a “Cyber Suraksha Handbook” for all the users. This handbook acts as a guide to stay safe online in the digital era and contains cyber safety guidelines for Work Place, Digital Life, teens and kids, and protection of Personal data.

Cyber Security practices followed at RIL are benchmarked against Industry Best standards such as NIST, ISO 27001, etc. RIL’s O2C and Retail businesses are ISO 27001 certified whereas Retail and RBML businesses have attained PCI DSS certification. Reliance is the only organised and multi-brand retail business in the country to demonstrate PCI DSS certification continuously for the last 10 years.

Multiple layers of proactive and reactive controls are adopted for Digital Services to mitigate the vulnerabilities. All systems and security tools are monitored for any cyberattacks via a 24x7 Security Operations Centre. Continuous Improvement programs are implemented to improve the maturity and the cyber security posture of the organisation. Additionally, Reliance also ensures that the cyber security posture is validated by third-party experts periodically to obtain additional layers of assurance.

Cyber Security Posture update is made to the Board Risk Management Committee at regular intervals and their guidance is taken to further improve on the posture.

Safety and Operational Risks

Health, Safety and Environmental (HSE) Risks

Impact on:

, all businesses

, all businesses

Risk Description

Managing HSE risks including short term, long-term effects to workforce, assets and public is critical to sustainable and responsible conduct of business operations. These risks may manifest during various phases of facility life cycle and vary in the magnitude depending on the geographic, demographic and regulatory regimes where we operate. Risks may also present themselves through external factors with an impact to company’s personnel and assets, like external events in the neighbouring industries and natural calamities.

With rapid-changes in the HSE regulatory requirement due to evolving global trends, changes in legal and regulatory framework, ask from investors, and customer awareness, it is compelling to stay abreast of these requirements for smooth operations and business continuity. The health risk is not only restricted to occupational health but also covers mental health of the workforce. The environment regulations are evolving, and becoming stringent for businesses due to risk of global warming and climate change risk. Safety risk is not only restricted to site operations but also require to capture risk across the upstream and downstream supply chain for business continuity.

Risk Response

Reliance’s motto of ‘Growth is Life’ has always been reinforced with our commitment on conducting safe, reliable, compliant and sustainable operations.

There has been a continuous endeavour to manage risks across our existing assets at Exploration & Production, Refining & Marketing, Petrochemicals, Polyester and other dispersed facilities through world-class HSE management practices. Implementation of advanced technologies like video analytics, robotics, remote-sensing devices for inspection have reduced personnel exposure to hazardous environment.

Our People are our critical assets in managing HSE risks. We have invested significant efforts in developing and maintaining in-house competencies which are critical to manage Safety, including managing Integrity Operating Window, advanced techniques of risk assessment, deep-dive technical analysis techniques and functional safety. This talent pool helps execute risk and control studies and provides assurance with agility, while leveraging industry expertise.

Our HSE risks and controls are maintained through digital platforms enabling traceability and transparency of information to all concerned workforce for effective prioritisation and decision making.

Our involvement in regulatory bodies in setting HSE standards and participation in international and national HSE forums further aids in imbibing High Value Learnings in conducting our operations. Reliance’s strong framework of auditing, assurance and third-party verification ensures effective governance of these practices.

With the diversification of operations towards Oil to Chemicals and New Energy, this year presented new opportunities to embed HSE management best practices in the novel technologies since the conceptual stage itself. This involved strategic partnerships with industry experts, application of scientific methods to analyse the risks in the new units and devising advanced technologies for risk mitigation.

Our flagship CASHE program has seen continuity for 20th year with massive involvement of asset facing teams and entire workforce in execution of ideas to improve Safety, Health and Environment.

Health of workforce including mental well-being has been a priority, with programmes organised through internal and external experts to provide support to workforce operating across locations.

Health and Safety Management System (HSMS) is developed and deployed with robust governance mechanism with an aim to identify, assess, respond and monitor, on a real-time basis, risks that impact business objectives.

The Retail Health and safety management system (HSMS) has been certified with ISO 45001:2018, an internationally recognised standard for Occupational Health and Safety management system. It recognises the best-implemented framework adopted by the organisation for identifying and managing occupational health and safety risks, improve performance, and promote culture of continual improvement.

Also, the approach and initiatives implemented in the business has been recognised by British Safety Council with “International Safety Award”. Retail Business was also conferred with “Road safety award” Gold with 4 stars at 7th OHSSAI HSE Excellence and Sustainability Awards for demonstrating a strong commitment to good road safety management programs and “Best ESG Initiative to Improve Employee Development” at 2nd ESG Summit and Awards 2022.

Safety and Environmental Risks during Transportation

Impact on:

, all businesses

, all businesses

Risk Description

RIL transports significant volume of crude oil & petroleum products on ocean-going tankers with attendant risks like HSE incidents, oil spills, etc. RIL also faces fires, explosion and other personal & process safety incidents besides risks arising from natural disasters, extreme weather, human error, etc. which could lead to loss of containment of hazardous materials, etc. RIL operates a fleet of tugs, port service vessels and operations of port and terminal infrastructure and is exposed to a complex and diverse range of marine risks, with respect to exploration vessels, oil tankers, chemical tankers, gas tankers, and dry cargo vessels.

Risk Response

RIL has instituted a suitable vessel vetting, incident monitoring and emergency response system. A third party vetting system provides a clear picture of the vessel quality based on extensive data analysis. Periodic vendor management audits are carried out for Time Charter and STS service providers in accordance with the Marine Assurance Framework.

Emergency Response system has been tried out in real scenario and found to be adequate. Incident Management includes root cause analysis and ensuring ship-owners’ addressal of the same. The data is further used in assisting legal/ operations matter in case of any potential losses to RIL as a result of the incident.

RIL’s control framework for road transportation has matured over a period of time and is run in collaboration with contractors. The contractors are supported by the Company through capacity building for their drivers in areas such as defensive driving, route hazard mapping and real time tracking. A dedicated state-of-the-art emergency response centre provides emergency response and incident management to transporters.

Physical Security and Natural Calamity Risks

Impact on:

, all businesses

, all businesses

Risk Description

Our business operations have a vast geographical spread, both onshore as well as offshore. This makes Reliance vulnerable to manmade and natural disasters such as insider threat, social unrest, cyclones etc. These threats may be amplified by divisive use of social media networks. Geopolitical developments too can have a defining impact on business operations. These could cause harm to our assets, people, information and reputation.

Even a seemingly minor incident has the potential to snowball and adversely impact our operations and stakeholders. Therefore, having high situational awareness with prompt and commensurate means to effectively respond in a proactive manner, is required to deal with all crises. Risk management and Business continuity plans are critical to ensure that business operations are not disrupted and if compromised, we should have the ability to restore the operations at the earliest.

Some of the network locations, offices, employees and other ecosystems are subject to various forms of intentional or natural disruptions, thereby impacting network availability, customer experience, restoration cost and efforts.

The growing E-commerce business is vulnerable to specific risks like Customer abuse (fake returns, related account abuse, fake claims - as order not received, empty box, wrong item received etc.), Account compromise, Brand infringement, Phishing/Vishing attacks etc. which are likely to increase manifolds. Of these, customer abuse is probably the most critical of risks. Fraudsters continue to innovate new methods to bypass system checks on Ecom platform/physical processes to defraud. There is thus a need to closely monitor these risks and have a robust mitigation strategy to protect business interests.

Risk Response

Global Corporate Security (GCS) focuses on adopting dynamic and pre-emptive risk management strategies to safeguard and secure the Company.

GCS is responsible for securing people, assets and operations of RIL. GCS works closely with the business teams to conduct a thorough and regular assessment of all the existing and evolving risks to our operations. This is accomplished by employing the best global practices and accepted mitigation strategies to minimise the risk exposure.

We employ the best-in-class security professionals with multi-domain knowledge to draw from their vast experience. We also work in close coordination with sovereign forces and conduct regular mock drills to ensure prompt and effective response to deal with any untoward situation. High level of real time situational awareness is maintained by integrating Human Intelligence (HUMINT), Open-Source Intelligence (OSINT) and security automation dashboard, at the security operation centres.

We constantly review and upgrade our security plans and incorporate latest technological developments to include integrated security platform, high end electronic sensors, drones, seamless communication and AI based analytics across the enterprise, along with Quick Response Teams (QRTs). GCS has robust business continuity plans that are regularly rehearsed, to deal with disasters, calamities, or any other disruptions.

Digital services have developed and implemented an Integrated Disaster Recovery and Emergency Response Process. Integrated response is facilitated by various teams such as security, customer services, corporate services, corporate communication, regulatory, network maintenance and the local geographical offices to keep the networks functional and customer services intact.

It has also implemented measures for prevention and detection to any physical security threats which includes patrolling the vulnerable areas, Real-time situational awareness by deploying alarms management and monitoring through centralised Networks Operations Centre (NoC). Disaster recovery processes and drills are also conducted for managing unscheduled downtime. Security & Loss Prevention (SLP) and Field Operations teams proactively supports in reducing pilferage, theft and losses, such as equipment thefts and pilferage of fuel by deploying physical security measure, alarm alerts, video based surveillance, GPS based trackers and consumption monitoring.

To immunise the business from online and e-commerce abuse, the SLP

E-commerce team is continuously monitoring data at a transaction level and providing mitigation strategies to business. Close coordination with field teams and strong IT footprint gives the robustness required for prompt support in response to red flags being raised.

Through rigorous data analysis, physical audits and investigations, the team has been able to identify critical gaps in existing processes/systems/tech issues which lend themselves to exploitation on Ecom platform. In addition, an online fraud prevention service (engine) is also envisaged as part of long term solution.

Compliance and Control Risks

Regulatory Compliance Risks

Impact on:

, all businesses

, all businesses

Risk Description

Increased regulatory scrutiny has raised the bar on regulatory compliance. This requires alignment of corporate performance objectives, with regulatory compliance requirements. COVID-19 has led the government to announce a range of notifications which companies need to adopt swiftly and effectively.

Changes in the regulatory environment, licensing processes and timelines could potentially impede the ease of doing business.

Risk Response

Reliance has adopted a digitallyenabled comprehensive compliance management framework. It is integrated with business processes, risks and controls. Changes in regulations are also tracked and integrated within the Reliance Compliance Management System. Effective control and efficient oversight of the senior management is ensured by cascading the responsibility matrix till the last performer of the activity. Apart from assurance through three lines of defense, compliances are also periodically monitored through the Segment Compliance Committees and the Group Compliance Committee.

Regular interactions with various trade associations/ councils help in anticipating regulatory environment and through attuning to any policy changes.

The Company’s code of conduct, training as well as focus on ensuring 100% compliance and continuous monitoring have enabled a mature, digitally-enabled compliance framework.

Financial Risks

Treasury Risks

Impact on:  , all businesses

, all businesses

Risk Description

RIL faces following key financial risks which is actively managed by Treasury Team.

Liquidity Risk

In FY 2022-23, inflation scaled higher in key economic regions of the globe on account of supply chain constraints. The onset of Russia Ukraine conflict drove commodity prices and inflation higher. Major central banks embarked on liquidity tightening measures through the year as inflation spiralled. On the domestic front too, banking liquidity and financial conditions tightened. Central banks are expected to calibrate their monetary stance based on the balance of risks of continuing inflation and those of financial stability.

Interest Rate Risk

Reliance borrows funds from Domestic and International markets to meet its funding requirements. Faced with the scenario of spiralling inflation, central banks across the globe raised policy rates through the year. US Fed raised rates by 450 bps. RBI was also quick to respond to rising inflation in India and raised policy rates by 250 bps. The rise in global and domestic rates translates into higher finance costs for RIL.

Foreign Exchange (FX) Risk

RIL avails LT and ST Foreign currency liabilities to fund its capital investments and working capital requirements. Rupee depreciation impacts the landed cost of the foreign currency liabilities. Given the steep rise in US interest rates, the Dollar remained strong against most currencies through the year. The INR depreciated sharply through first half of the year and closed the year with a depreciation of 8.4%.

Credit Risk on Investment Portfolio

Reliance deploys its investible surplus in Government securities, State Government securities, AAA Corporate bonds, Fixed Deposits and Debt mutual funds. Corporate bonds and Debt Mutual Fund investments bear credit risk.

Risk Response

RIL maintained healthy liquidity buffer as it had raised Long term Senior unsecured notes of $4.0 billion in January 2022. Even as liquidity tightened through the year, RIL and its subsidiaries accessed Short Term markets comfortably and raise short term INR liabilities (including Commercial Paper, Short-Term Loans and Overdrafts against FDs) to fund its working capital requirements. Reliance’s Retail business too strengthened the liquidity position by raising Term Loans to fund its capex and business requirements.

Interest rate risk is managed actively by maintaining an appropriate mix of Fixed and Floating rate liabilities which limits the translation of rise in market interest rates into higher coupon costs of market liabilities. RIL has raised significant amount of fixed rate liabilities over the FY 2022-23 and 2H FY 2021-22.

Foreign Exchange (FX) risk arising from the mismatch of foreign currency assets, liabilities and earnings is tracked and managed as per the Internal Risk Management Framework. A significant portion of the payables and receivables of the Hydrocarbon business are in dollars which minimises the cash flow risk on account of fluctuations in foreign exchange rates.

Direct investments are restricted to Board approved select AAA rated corporates. Debt Mutual Fund investments are managed and monitored based on a Internal Risk Management Framework.

Insurance – Risk Mitigation

Corporate Risk Management philosophy of RIL inter alia deals with protection of unforeseen risks by transferring them to insurers. While buying the protection through insurance, it is always our endeavour to have best possible cover on all risk basis to meet any eventuality which may affect our balance sheet. Risk transfer to insurer through insurance is used as risk management tool for protection of all assets and liabilities arising due to business risks. A thorough examination is made for identification of risk, verification and counter verification is done before arranging risk protection. Selection of partner insurers are done after complete verification and is decided based on their balance sheet strength and solvency ratio.

Looking Ahead

Our commitment to sustainable development goes beyond our operating boundaries. We continuously aim to add value to our stakeholders by improving lives. We are committed to help in bridging the Green Energy divide in India and the world through our New Energy business. We continue to build on our leadership in the O2C business with new capacities and capabilities. Jio is rolling out 5G network across India and has developed deep expertise in multiple emerging technologies like AI/ML and blockchain and Mixed Reality. Jio Platforms is blossoming into a global technology player to provide unique digital products and solutions. Reliance Retail has emerged as the fastest growing retailers with the widest and deepest reach in India, across all product baskets. Reliance’s risk management enables effective management of all categories of risks in a shared language understood by all levels across the Group, from the Board room to front line. Reliance’s risk management is agile for course correction and is scalable to support new businesses and ventures.