Management Discussion and Analysis

Financial Performance and Review

Srikanth

Venkatachari

Soumyo

Dutta

Anshuman

Thakur

Dinesh

Taluja

Saurabh

Sancheti

C. S. Borar

Raj

Mullick

Sumit

Mantri

Despite global headwinds, India’s economic performance was surprisingly robust, catalysed by strong domestic consumption and a pick-up in investment.

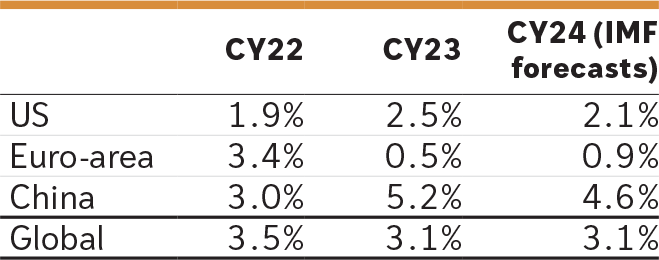

Global Economy

Global economic growth remained steady with above-trend growth in the US and a bounce-back in Chinese economy.

Indian Economy

India registered a GDP growth of 8.2% for FY24 (7.2% in FY 2022-23). India’s macro-economic outlook remains robust amid strong domestic consumption and a pick-up in investment. Government capex registered 25%+ Y-o-Y growth. Inflation moderated to 4.9% Y-o-Y by Mar-24 from an average of 6.7% in FY 2022-23. Core CPI inflation fell to 3.2% (all time low).

Current account deficit (CAD) remained below 1.5% of GDP and FX reserves above US$ 600 billion. India’s net services exports grew at 15%. India’s share in world’s services exports now stands at ~10%. Direct tax to GDP is at record high of 6.7% (vs pre-COVID at 5.5-6%). India’s oil demand stood at 233.3 MMT for FY24 (up 4.6% Y-o-Y). Demand for natural gas was at 66.6 BCM (up 11.1% Y-o-Y).

India continues to attract robust foreign inflows. FY24 inflows were resilient at US$ 44 billion. India is well positioned to continue being the fastest growing major economy with growth expected at 6.5% for the coming two years as per IMF.

Performance Overview

Reliance delivered robust annual performance on both operating and financial parameters. Notably, all segments contributed positively to earnings growth during the year.

The Company achieved a consolidated revenue of ` 10,00,122 crore (US$ 119.9 billion), up 2.6%, as compared to ` 9,74,864 crore in the previous year. Revenue was boosted by robust growth in retail and digital services business, with an increase of 17.8% and 11.0%, respectively.

Profit

Consolidated EBITDA for the year increased by 16.1% to ` 1,78,677 crore (US$ 21.4 billion) as compared to `1,53,920 crore in FY 2022-23. EBITDA growth was led by 28.4% increase in Retail segment, benefitting from improved operating leverage, higher footfalls and growth in digital channels. Digital Services segment EBITDA also grew by 12.7% on account of higher revenue with increased subscriber base and higher customer engagement. O2C EBITDA grew marginally Y-o-Y, supported by strength in cracks for transportation fuels. Weakness in global downstream chemical margins and impact of major planned turnaround at the Jamnagar complex was offset by moderation in SAED. Oil & Gas segment EBITDA increased by 48.6%, supported by 56.8% higher gas production in KG-D6 block. Cash Profit increased by 12.7% to ` 1,41,969 crore as compared to ` 1,25,951 crore in the previous year. Profit After Tax was higher by 7.3% at ` 79,020 crore despite higher finance cost, depreciations and taxes.

Gross Debt

Reliance’s Gross Debt was at `3,24,622 crore (US$ 38.9 billion). Standalone gross debt was at `2,11,790 crore with balance in key subsidiaries including Reliance Retail (`41,317 crore), Reliance Jio (`54,350 crore), Independent Media Trust Group (` 7,317 crore) and Reliance Sibur Elastomers (` 1,612 crore).

Capex

Capital expenditure for the year was ` 1,31,769 crore (US$ 15.8 billion) as against ` 1,41,809 crore in the previous year, with investments into network expansion in the digital services segment, scaling-up of the retail business, augmented production capacities in the Oil and Gas segment and projects in the O2C vertical. Capex was well covered by internal cash generation during the year.

Standalone

RIL’s Standalone revenue for FY 2023-24 was ` 5,74,956 crore (US$ 68.9 billion), a marginal decrease of 0.5% as compared to `5,78,088 crore in the previous year. Standalone EBITDA stood at ` 86,393 crore (US$ 10.4 billion) as against ` 77,918 crore in the previous year. Strong contribution from Oil & Gas business was partially offset by weak O2C. Profit After Tax was at ` 42,042 crore (US$ 5.0 billion), a marginal decline of 2.2% against `43,002 crore in the previous year. Basic EPS on Standalone basis for the year was ` 62.14 as against ` 63.56 in the previous year.

Movement in Key Financial Ratios

- The net capital turnover ratio improved from 16.97 in FY 2022-23 to 25.43 in FY 2023-24, due to lower working capital.

- Return on investment increased from 6.7% in the previous year to 8.5% in FY 2023-24 due to higher yields on the investments portfolio.

- The inventory turnover ratio decreased to 7.31 in FY 2023-24 as against 10.49 in the previous year primarily due to higher inventories.

- The return on net worth* fell to 10.3% in FY 2023-24 as against 10.9% in previous year due to marginally lower profits on weak O2C earnings and higher taxation.

Liquidity and Capital Resources

Macro Environment

In FY 2023-24, global financial markets experienced significant volatility, marked by unpredictable shifts in sentiments, from growth concerns to inflation worries. In the US, it was a year of two halves. The first half experienced heightened financial market volatility stemming from fears of potential banking crisis followed by improvement in risk sentiment due to decisive fiscal interventions and decline in the US headline CPI inflation to 3-3.5%. The second half was marked by resurgence of inflationary and growth pressures, leaving markets uncertain about future inflationary conditions, growth prospects, and quantum of policy rate cuts.

In India inflation declined steadily, with headline inflation reaching 5.1% in 4Q FY 2023-24, and core inflation falling below 4%. The inclusion of Indian sovereign bonds into JP Morgan’s GBI-EM global index in 2Q FY 2023-24 is expected to attract an estimated US$ 25 billion in foreign inflow. Additionally, the Government of India announced a steady fiscal consolidation path which helped in easing G-sec yields despite global challenges. India’s growth advantage coupled with expectations of sub-1.5% GDP Current Account Deficit, and low USDINR volatility should bolster the Indian Rupee in the short to medium term.

RIL successfully navigated this environment while maintaining adequate liquidity, managing financial market risks, and delivering consistent returns on its investment portfolio.

Fund Raising

Despite challenging market conditions, RIL and its subsidiaries successfully raised financing across various markets, currencies, and financial products at competitive cost to finance capital expenditure, support business expansion, and refinance maturing debt.

Offshore Facilities

Syndicated Term Loan Facilities (US$ 4.45 billion equivalent)

- US$ 2 billion equivalent facilities were secured by the Company and its subsidiary, Reliance Jio Infocom Limited (RJIL), to finance capital expenditure.

- US$ 2.45 billion equivalent facilities were arranged to refinance maturing debt. This transaction was well-subscribed in the primary syndication market from global lenders across geographies.

ECA Supported Facilities (US$ 2.83 billion equivalent)

- RJIL secured US$ 2.2 billion equivalent facilities to finance equipment and services for its pan-India 5G rollout comprising first ever Finnish Export Credit Agency (Finnvera) supported facilities of US$ 1.6 billion equivalent and US$ 0.6 billion equivalent facilities from Canadian Export Credit Agency (EDC).

- The Company tied-up Korean Export Credit Agency (K-EXIM) supported facilities aggregating a US$ 625 million equivalent to finance the purchase of Floating, Production, Storage and Offloading (FPSO) vessel in the Oil & Gas business.

Onshore Facilities

RIL issued ` 20,000 crore 10-year nonconvertible debentures (NCD), marking the largest single-tranche NCD issuance by a non-financial entity in Indian capital markets and the second largest issuance ever in terms of size. The NCDs were issued at rates which were RIL’s lowest coupon ever and at the tightest spread over sovereign credit.

Liquidity Management

RIL places a strong emphasis on liquidity management, to ensure that the Group always has an adequate cushion to effectively mitigate market disruptions and meet its short-term obligations. The Company effectively optimises borrowing costs and finances working capital by extending payables, accelerating receivables, and utilising various debt instruments. RIL’s investment strategy safeguards its financial resilience while optimising growth opportunities. The portfolio is continuously calibrated to balance the objectives of capital preservation, stable returns, and ready access to liquidity.

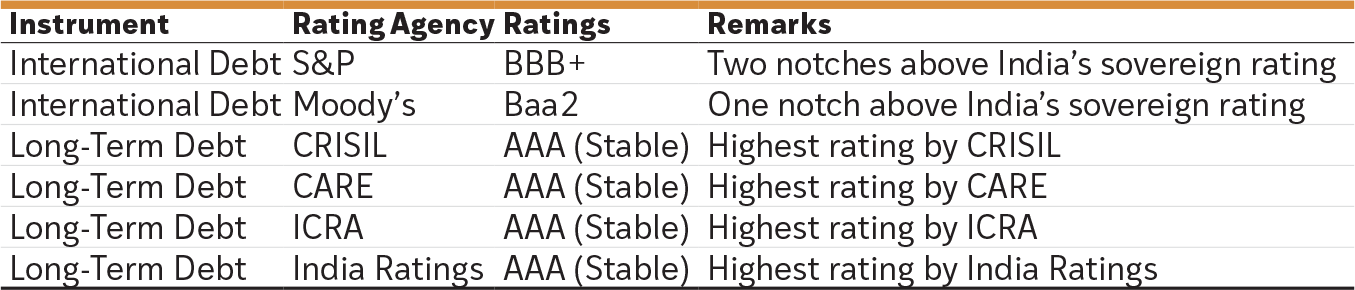

Credit Rating

RIL continues to be rated two notches above sovereign by S&P and one notch above sovereign by Moody’s.

RIL remains resolute in its commitment to foster sustainable value for its stakeholders through disciplined capital allocation, maintain appropriate leverage and optimally utilise its resources. The Company’s focus will be geared towards enhancing resilience and agility in its response to evolving market conditions. RIL will continue to monitor financial markets to seize suitable opportunities for capital-raising to support its growth plans, while maintaining a sharp focus on financial discipline and risk management.