KG Basin

KG-D6 Deepwater Production Update

Since the commencement of

production, Block KG-D6 established

several global benchmarks in terms of

operational performance, including

99.9% uptime and more than 13 years

of incident-free operations.

The next wave of projects – R Cluster,

Satellite Cluster, and MJ – have been

commissioned and are currently under

production. These projects have

leveraged the hub infrastructure in

place, thereby reducing cost.

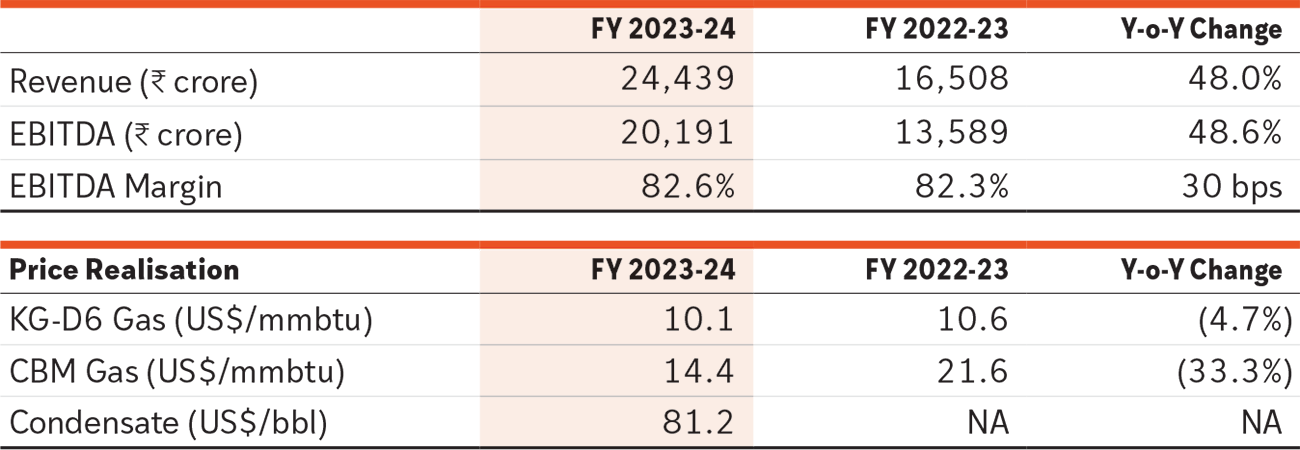

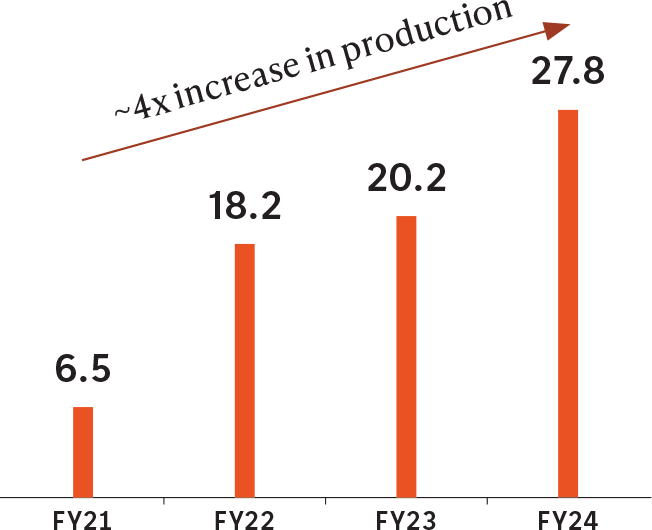

Average production for FY 2023-24

from the three fields together is

~27 MMSCMD gas and ~18,000 bbls

per day of oil and condensate.

Production is in line with expectations.

Based on the comprehensive

assessment undertaken with more

than two years of production data,

three additional wells in R Cluster and

one additional well in Satellite Cluster

are being proposed to be drilled. This

is expected to provide incremental

recovery of ~240 BCF of gas from

these fields.

In line with the increasing gas

production, three rounds of e-auction

were successfully completed. Overall,

15 MMSCMD gas contracts were

signed with buyers across Fertiliser,

CGD, Refineries, and Aggregators.

Condensate production commenced

from the MJ Field in KG-D6 Block

in April 2023, after which first

auction process was launched in May

2023. Five rounds of auction were

conducted and 12 cargo offtakes were

successfully completed by the end of

March 2024.

~27 MMSCMD

Average gas production in

FY 2023-24

Exploration Strategy

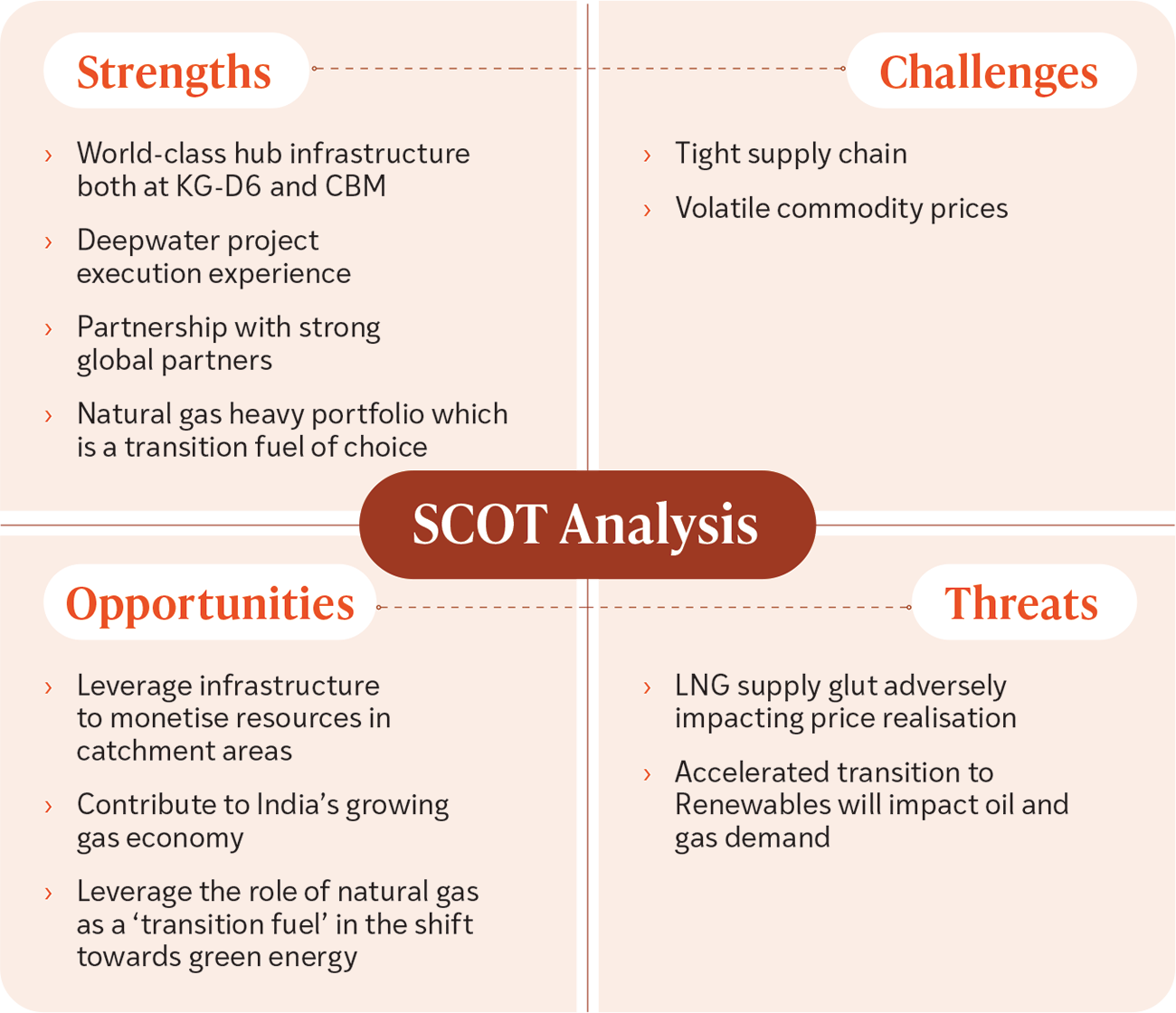

RIL’s exploration strategy is focused on

finding additional gas accumulations

that can be tied back to the existing

world-class infrastructure, using

an infrastructure-led exploration

(ILX) approach.

Block KGUDWHP-2018/1 (KG-UDW1)

was awarded to RIL-BP JV under

the OALP II licensing round, and the

Petroleum Exploration License (PEL)

was issued in August 2019.

Post completion of 3D Seismic

Acquisition and Processing campaign,

the first exploration well was drilled in

the Block, and the drilled well data are

under analysis.

During the year, RIL acquired Block

KG-UDWHP-2022/1 (KG-UDW2) under

the OALP VIII licensing round. The

contract for the Block was signed in

January 2024.

Coal Bed Methane

RIL is currently producing Coal Bed

Methane (CBM) from its block SP

(West)–CBM–2001/1. More than

300 wells are in production, with an

average output of 0.64 MMSCMD gas

during the year.

To augment and sustain production,

a 40 multi-lateral horizontal well

programme is being executed in SP

(West). This is the first time in India

that such horizontal wells are being

drilled for CBM. Reliance has already

drilled 13 horizontal wells, out of

which 10 wells are put on production.

Preliminary results are encouraging.

Reliance Gas Pipeline Limited, a

subsidiary of RIL, operates the 302 km

Shahdol-Phulpur Pipeline from Shahdol

(MP) to Phulpur (UP) connecting the

CBM Gas fields with the National

Gas Grid. This provides access to

consumers across the country.