Strategic Objective

Build Reliance as one of the world’s leading O2C, New Energy and New Materials company with a sustainable and circular business model

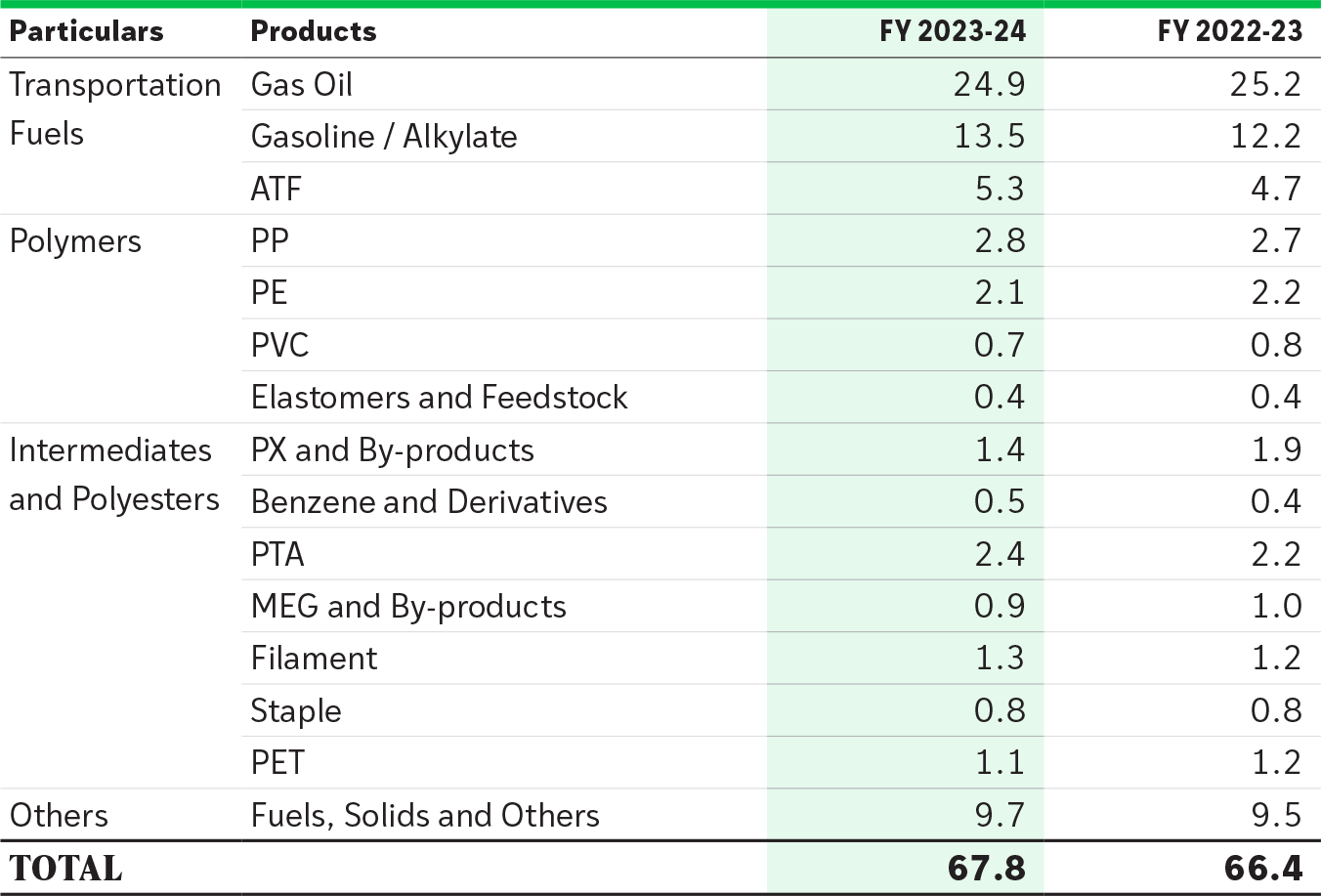

67.8 MMT

Production meant for sale

78.2 MMT

Total throughput

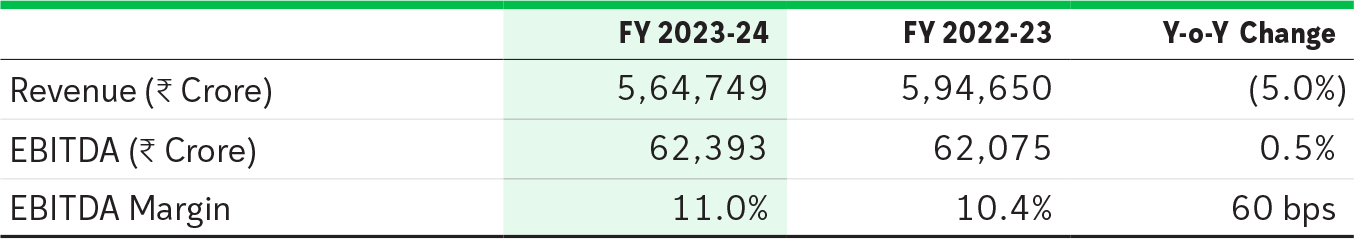

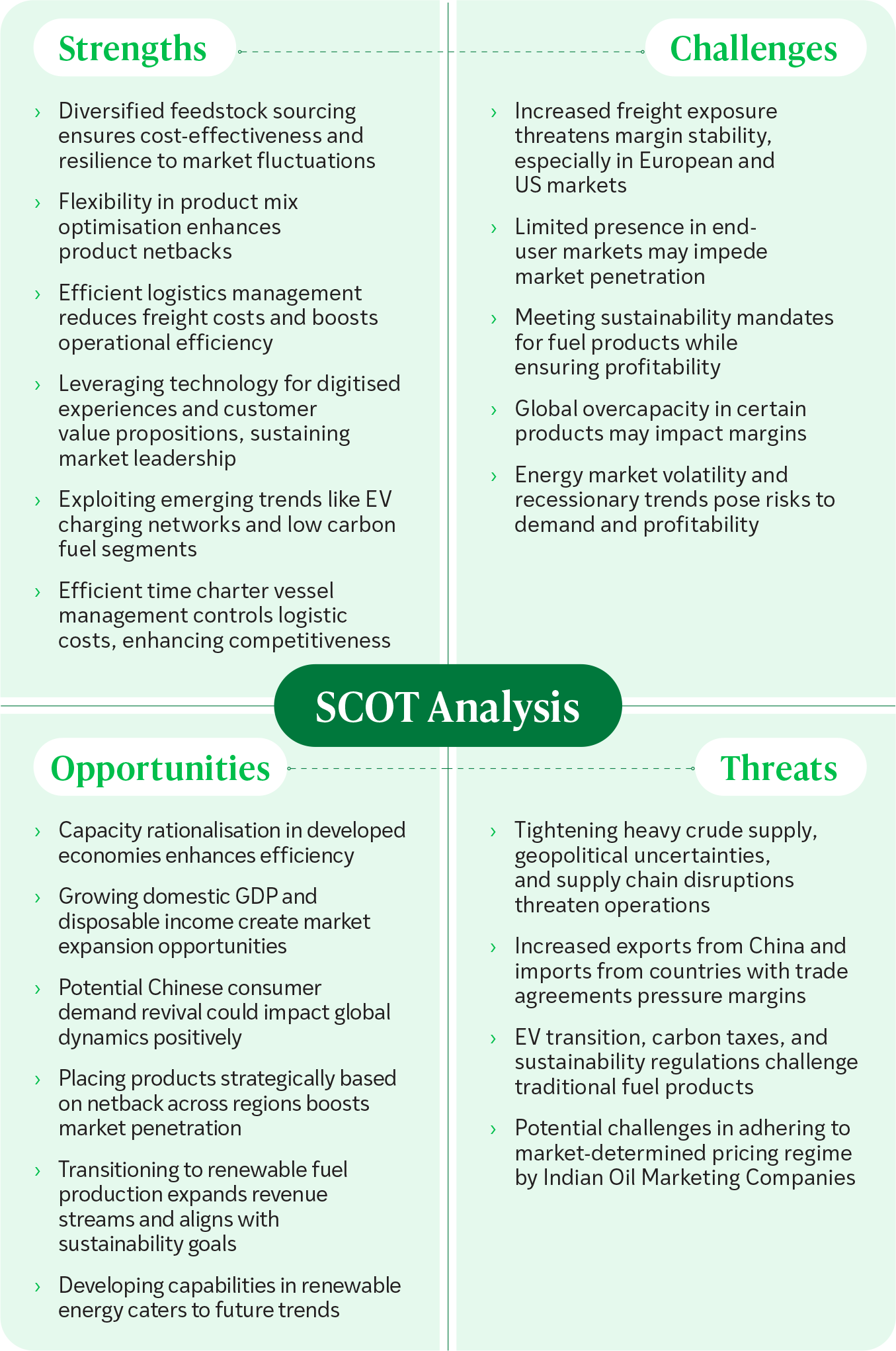

The Oil to Chemicals (O2C) business portfolio spans transportation fuels, polymers and elastomers, intermediates, and polyesters. The O2C business includes world-class assets comprising refineries and petrochemical units that are deeply and uniquely integrated across sites along with logistics and supply chain infrastructure.

The RIL O2C business includes a 51% equity interest in a fuel‑retailing JV with bp – Reliance BP Mobility Limited (RBML) – operating under the brand name Jio-bp, and a 74.9% equity interest in Reliance Sibur Elastomers Private Limited (RSEPL).

The integrated O2C business structure enables an integrated decision-making approach that helps to optimise the entire value chain from crude to refining to petrochemicals to the B2B/B2C model. The O2C business will further leverage technology and its existing assets and streams to maximise conversion of crude to chemicals and materials, with an aim to create a sustainable, holistic, circular materials business.

Nikhil

R. Meswani

Hital R.

Meswani

Akash

Ambani

Isha

Ambani

Anant

Ambani

P. K. Kapil

Sanjiv

Singh

Srinivas

Tuttagunta

J. Rajaraman

Harish

Mehta

Amit

Chaturvedi

Puneet

Madan

Sanjeev

D. Sharma

Hemant

D. Sharma

Piyush

Bhatt

C. S. Borar

Ashwani

Prashara

Seema

Nair