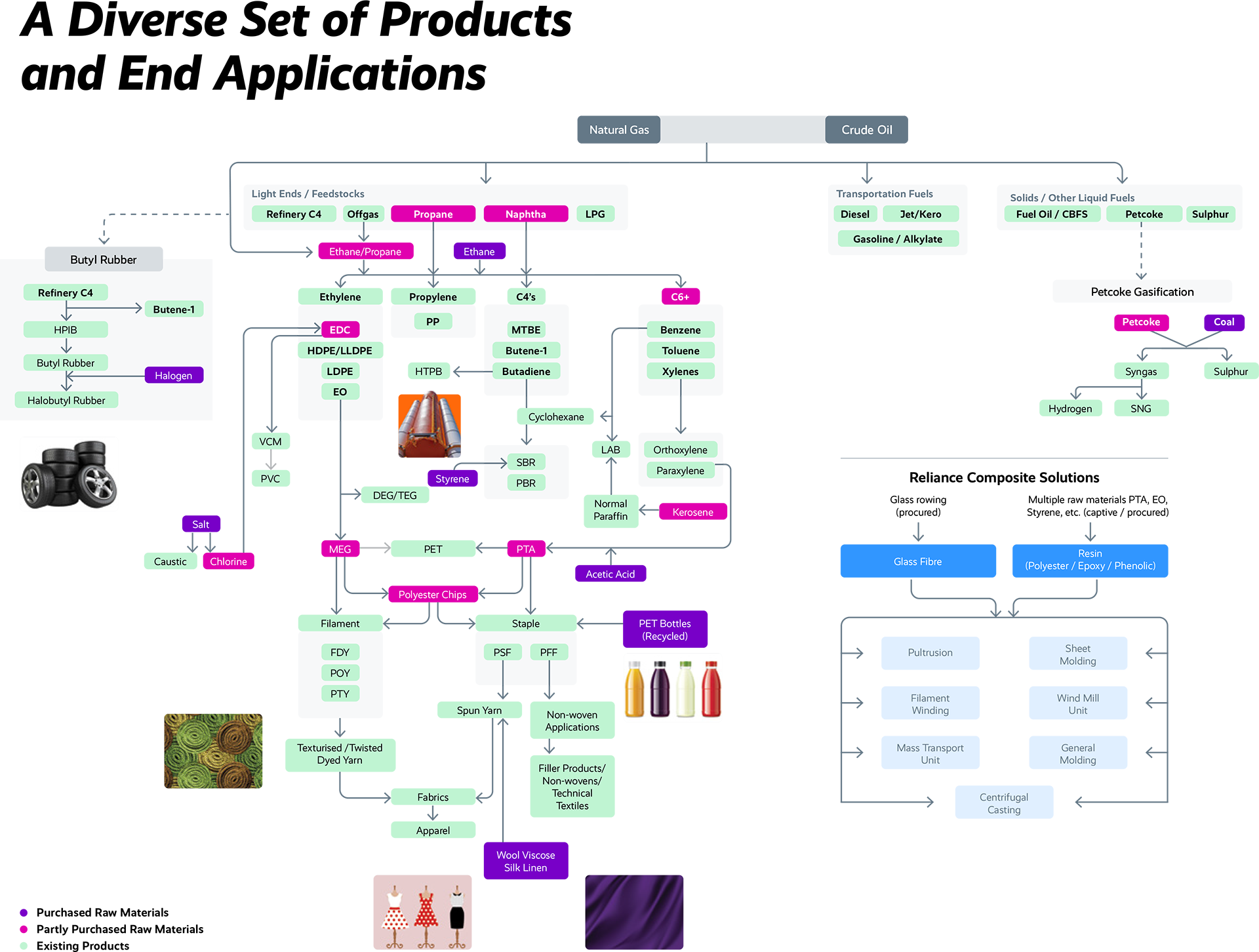

The Oil to Chemicals (O2C) business portfolio spans transportation fuels, polymers and elastomers, intermediates and polyesters. The O2C business includes world-class assets comprising refineries and petrochemical units that are deeply and uniquely integrated across sites along with logistics and supply chain infrastructure.

The RIL O2C business includes a 51% equity interest in a fuel retailing JV with bp - Reliance BP Mobility Limited (RBML), operating under the brand Jio-bp, and a 74.9% equity interest in Reliance Sibur Elastomers Private Limited (RSEPL).

The integrated O2C business structure enables an integrated decision-making approach that helps to optimise the entire value chain from crude to refining to petrochemicals to the B2B/B2C model. The O2C business will further leverage technology and its existing assets and streams to maximise conversion of crude to chemicals and materials, with an aim to create a sustainable, holistic, circular materials business.

Continued recovery in global oil demand and consequent increase in product prices propelled the O2C business. High operating rates supported by superior product placement partially offset higher feedstock prices and volatility, leading to strong performance during the year.

VISION AND MISSION

Accelerate new energy and materials businesses while ensuring sustainability through circular economy and target to become Net Carbon Zero by 2035.

COMPETITIVE MOAT

Deep and Unique Integration Across Sites

- Fully integrated O2C value chain comprising the highly integrated complex at Jamnagar, with strong linkages to other O2C sites

- Flexibility to process a variety of feedstock including crude, condensate, naphtha, refinery off-gases, ethane/ propane, reformate, vacuum gas oil and straight run fuel oil

- Highly optimised operations across the entire value chain from crude selection, product yield management, logistics to product placement, leading to bestin-class profitability

- Presence across diverse product categories, feedstock flexibility and security provides stability of cash flow even in volatile commodity markets

World-class Manufacturing Facilities

- Large global-scale manufacturing sites based on competitive technology and flexible design

- Top quartile performance in costs, safety and operational excellence

Unparalleled Logistics and Supply Chain Network

- Unmatched distribution footprint in India with multi-modal logistics

- 10,500+ customers for chemicals and materials across India

- Retailing transportation fuels at 1,560+ outlets spread across India

Strong Project Management Capability

- Track record of delivering world-class, large-scale projects

Robust Portfolio Catering to Growing Consumption Markets

- The only company globally with integration from oil to transportation fuels, polymers and elastomers, intermediates, and polyesters

Global Competitiveness and Leadership

- World’s 3rd largest producer

of paraxylene and among

the world’s top Five

producers of PP and PTA

(Source: Chemical Market Analytics / Wood Mackenzie) - World’s largest integrated polyester producer

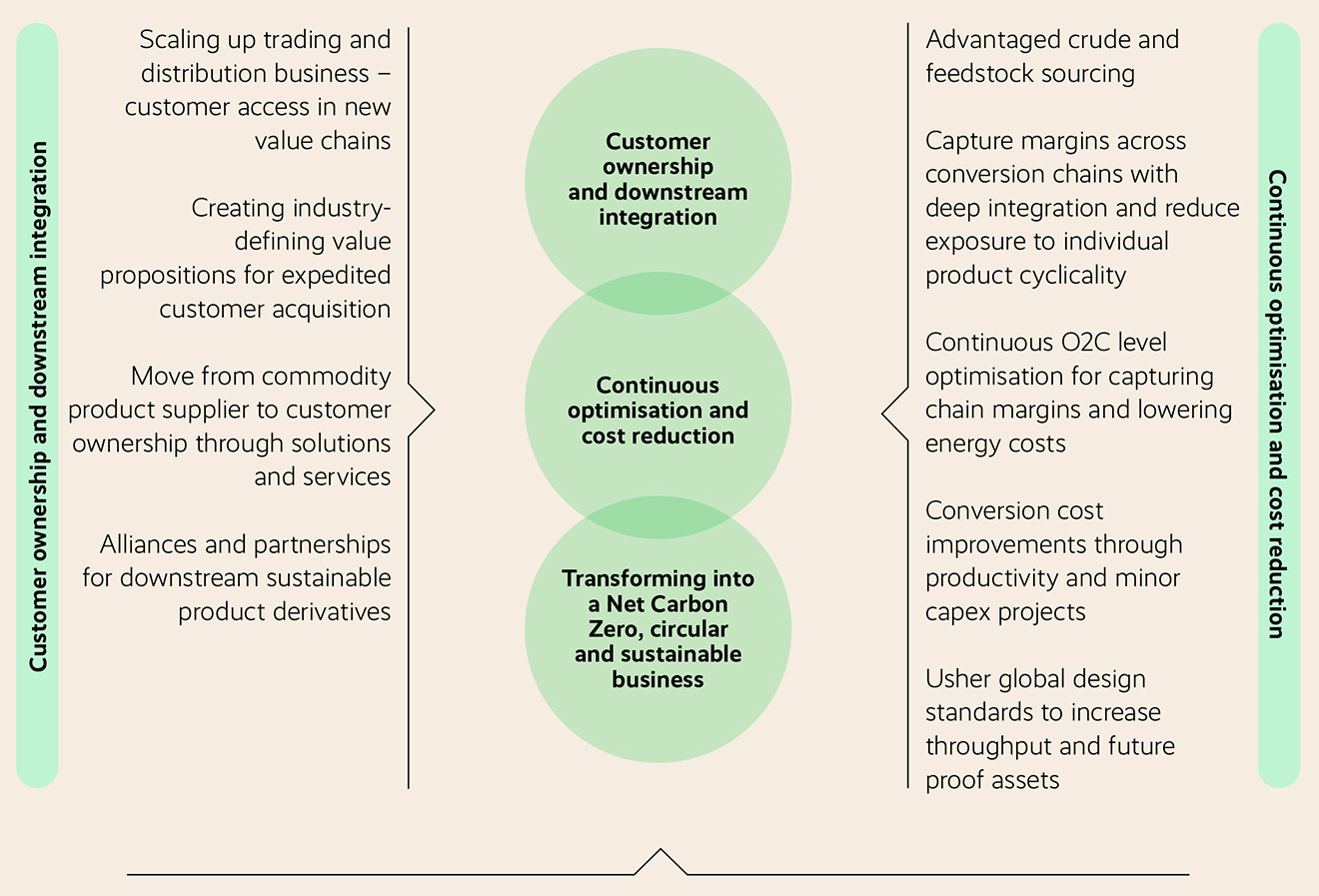

OPERATING FRAMEWORK

The key priorities of the O2C

business are as under:

- Transition from producing transportation fuels to chemical building blocks integrated with sustainable downstream derivatives

- Transition from fossil fuels to renewables to meet energy demand

- Focus on innovation and sustainable product development

- CO2 capture and conversion to useful chemicals and materials

- Scaling up recycling in materials

- Riding transition from traditional to advanced mobility with EV solutions

- Accelerate gas economy through expedited growth of CNG and Bio CNG network

OPERATIONAL HIGHLIGHTS FY 2022-23

Highest ever O2C earnings pre-SAED (Special Additional Excise Duty) with tight fuel market due to geopolitical conflicts and recovering global demand post reopening of economies

Fluid Catalytic Cracking (FCC) de-bottlenecked during shutdown to enable O2C transition with superior petrochemical yields and improved feedstock flexibility

Weak global demand for petrochemicals weighed on chemicals margin but RIL margin remained resilient on sustained domestic demand and advantaged ethane cracking

Maximised margins with advantaged feedstock sourcing, yield optimisation and superior product placement

Crude sourcing flexibility improved with de-bottlenecking of naphtha, handling capability in CDUs

Improved and sustained gasifier performance ensuring zero LNG imports in high price scenario, reducing the energy cost

Maximised primary and secondary units processing to capture higher refining margins

Aromatics production optimised based on net-back for alternate product (PX vs Gasoline)

Focused on differentiated and specialty polyester products

Jio-bp added 1,000+ new charging points and a multitude of industry level partnerships, to strengthen position amongst the country’s leading CPO (Charge Point Operator)

Processed 13 new crudes, widening feedstock sources including feedstock for Fluid Catalytic Cracking (FCC)

Cracker feed-mix optimised based on Naphtha Vs Ethane economics, lower US ethane prices supported chemical margins

INDUSTRY OVERVIEW

FY 2022-23 was a year of high volatility and uncertainty in oil markets amid higher geopolitical tensions due to the Russia-Ukraine conflict.

This led to significant rise in oil prices in the year with Brent crude reaching $123.7/bbl in June 2022.

Europe imposed an embargo on imports of Russian crude oil and refined products in December 2022 and February 2023 respectively. These European sanctions further led to re-routing of global crude and product trade flows.

Global oil demand continued to rise in FY 2022-23 despite being impacted by high oil prices, China’s Covid lockdowns during the first half of the year, and global economic growth concerns during the second half of the year.

International air travel rose steadily throughout the year as most countries lifted restrictions with covid related concerns receding. Global refinery operations also increased on support of rising demand. Improving mobility and gas to oil switching, amid high natural gas prices, also supported oil demand growth during the year.

Tightening of monetary policy by Central Banks caused concerns on economic recovery leading to sharp drop in oil prices in March 2023.

Crude Oil Demand and Supply

Global Oil demand in CY 2022 increased by 2.3 mb/d to 99.8 mb/d.

High oil prices and China Covid lockdowns limited oil demand growth in the year. However, demand growth was supported by improving mobility, rising air travel demand, increasing use of oil for power generation and gas to oil switching in the industrial sector.

Global oil supply increased by 4.5 mb/d to 99.9 mb/d in CY 2022. Oil supply growth was strong in the year in both OPEC and Non-OPEC countries. OPEC supply growth was led by Saudi Arabia, UAE and Iraq. Non-OPEC supply growth was led by US.

Global Refining Operations

During FY 2022-23, Global refinery operations increased steadily on the back of strong demand, high refinery margins and also due to start-up of new refineries in Middle East, US and China.

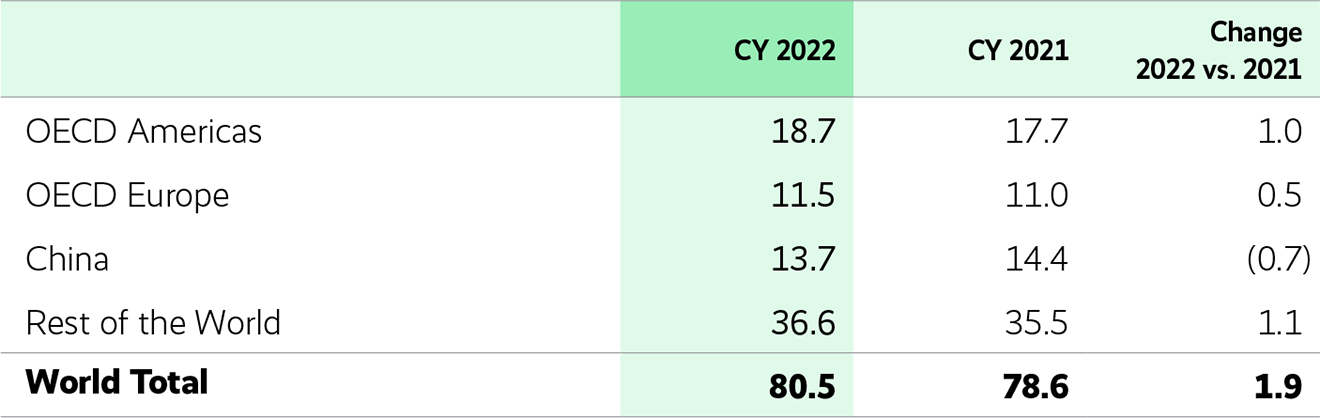

In CY 2022, global refinery throughput was 1.9 mb/d higher than in CY 2021. Overall refinery utilisation reached 82% by March 23. Refiners increased run rates to take advantage of the higher product cracks.

Refining margins were strong in FY 2022-23 as concerns of loss of Russian product exports to Europe due to sanctions led to huge disruption in global trade flows. Margins were healthy in the year mainly due to strong middle distillate cracks amid rising fuel demand and lower global inventories.

GLOBAL REFINERY CRUDE THROUGHPUT

(MB/D)

Source: IEA

Crude Oil, LNG and Ethane Prices

Oil Prices

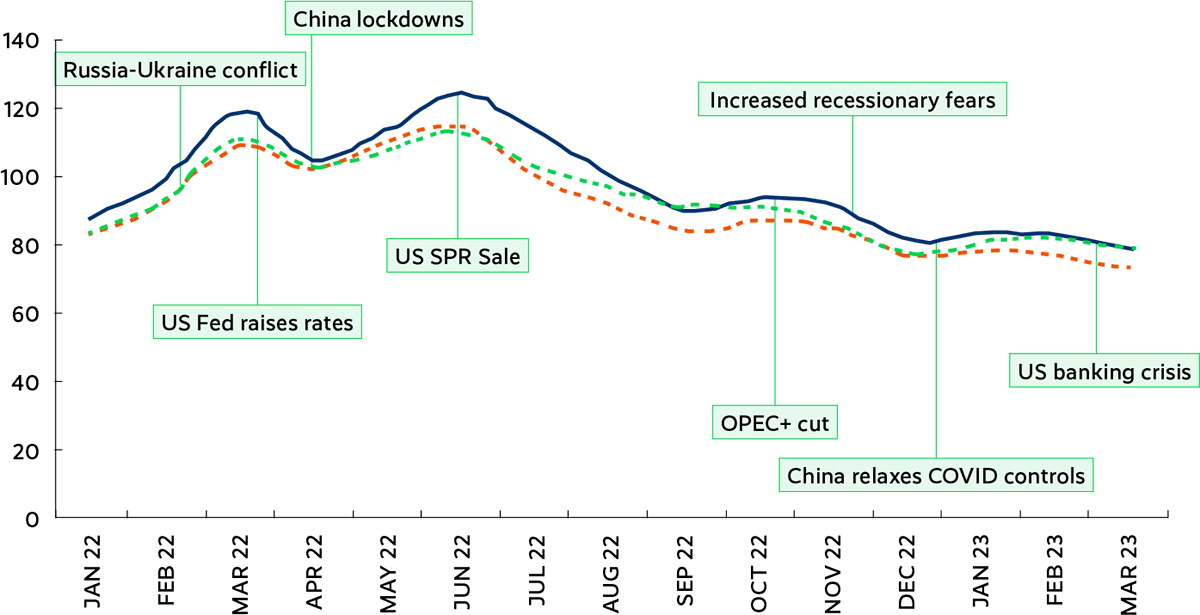

Crude oil prices rose sharply in FY 2022-23 with Brent price averaging $96.2/ bbl in the year. Higher crude oil prices during February 2022 to August 2022 were mainly on account of war premium as an after effect of Russia Ukraine conflict. Brent oil rose to high levels of $123.7/bbl in June 2022 amid rising demand and on concerns of impact of upcoming EU embargo on Russian oil imports from December 2022. However, Oil prices started to cool down after June 2022 as US increased SPR oil sales and Russia was able to divert much of its crude oil exports from Europe to Asia.

Oil price volatility continued through the year with Brent oil prices falling to $81.1/ bbl in December 2022 on recessionary concerns while Russian oil exports remained resilient. China lifting COVID-19 restrictions in December 2022 pushed up oil prices again in January-February 2023 although banking crisis in US pulled prices down in March 2023.

CRUDE OIL PRICES

(US$/BBL)

Source: Platts

LNG Prices

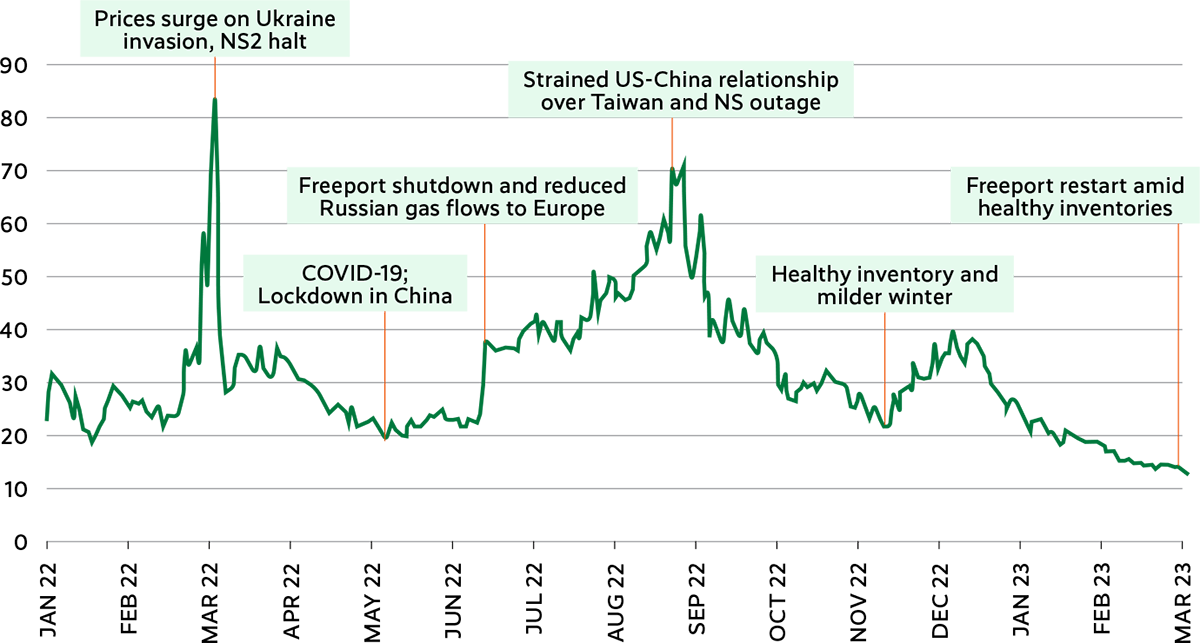

During the year, LNG prices were highly volatile, with Asian prices ranging from a high of $71.25/MMBtu in April 2022 to a low of $12.10/ MMBtu in March 2023. Asian LNG prices averaged at $32.96/MMBtu in FY 2022-23.

Geopolitical tensions reduced pipeline gas flow from Russia to Europe leading to decrease in European inventories by Q1 2022. Also, significant outages at LNG terminals like USA, Australia, Malaysia tightened LNG availability during FY 2022-23.

In anticipation of the winter season, despite a tight LNG market, Europe acquired an additional 45 MT of LNG over and above their 2021 volume to substitute Russian pipeline gas to build inventory.

These events resulted in significant increase in LNG prices during Q2 2022. However, high LNG prices and tight COVID restrictions in China led to demand destruction in Asia (7%) and Europe (13%).

In addition, the relatively mild winter experienced in Europe and Asia resulted in sustained high inventories towards the end of winter 2022, which subsequently contributed to reduction of LNG prices by March 2023.

LNG PRICES

(US$/MMBtu)

Source: Reuters

Ethane Prices

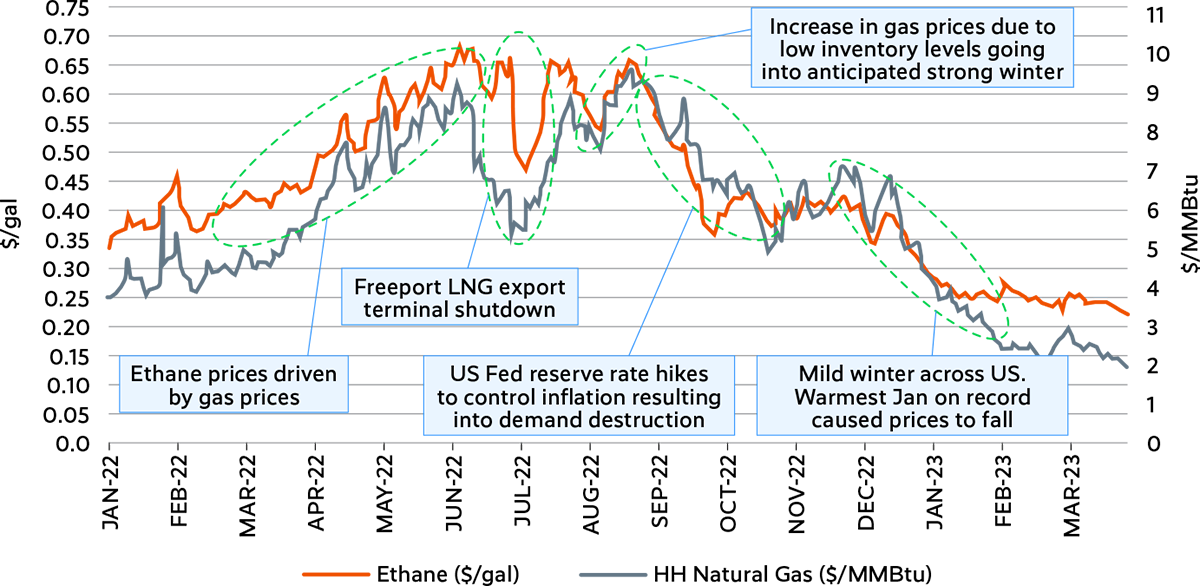

In February 2023, Reliance completed six years of ethane value chain project.

The ethane chain acted as a virtual pipeline from US to India ensuring uninterrupted ethane supply to our crackers and providing them feedstock security, flexibility and a unique competitive advantage.

During the year, ethane prices were highly volatile, seeing a high of 68.0 US cents per gallon (cpg) in June 2022 and a low of 22.7 cpg in February 2023. As ethane prices moved in tandem with natural gas prices for most of the year, prices peaked in anticipation of strong winter and low inventory levels. However, the Freeport LNG terminal shutdown, rising interest rates and milder winter eased ethane prices.

The average price of ethane for FY 2022 -23 was 44.4 cpg. Despite relatively higher prices, ethane continued to be the preferred as a competitive feedstock in the region.

US ETHANE AND NG PRICES

(US$/GAL) / (US$/MMBtu)

Source: Reuters

Transportation Fuels

Global Market Environment

Global gasoline demand growth remained steady during the year on rising mobility. In CY 2022, demand recovered to 97.5% of pre-pandemic levels (CY 2019 levels) to 26.0 mb/d as restrictions on mobility were lifted gradually by various countries. China lifted Covid related mobility restrictions in December 2022.

Global diesel demand was strong during the year due to improving economy and rising industrial activity. In CY 2022, diesel demand recovered to pre-pandemic levels to reach 28.3 mb/d.

Jet fuel demand gradually increased through the year. It recovered to 78% of pre-pandemic levels in CY 2022 to 6.2 mb/d amid slow recovery in business and international travel.

Domestic Market Environment

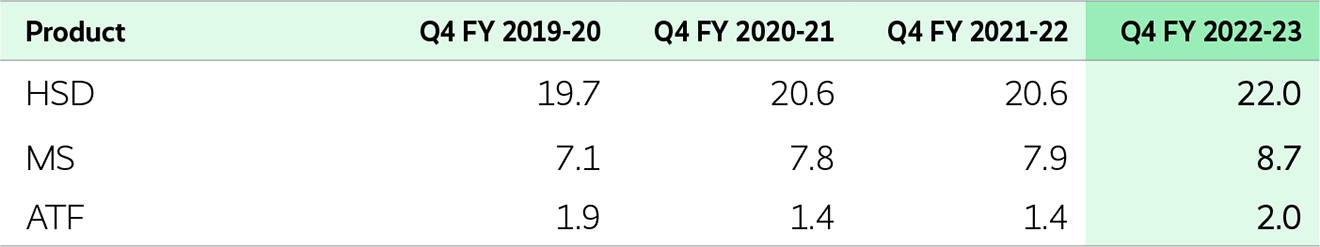

Indian transportation fuel market has bounced back completely to register new highs across both HSD and MS segment in FY 2022-23. Despite being significantly below pre-covid levels, ATF volumes have shown the steepest growth.

With this being the first complete year since FY 2020-21 without any specific (pandemic led or otherwise) demand disruption in the country, there has been healthy growth of petroleum products in the country despite elevated retail selling prices.

India’s oil demand grew by 10.2% and stood at 222.3 MMT. LPG demand also maintained an upward growth trajectory.

Strong economic traction is reflected in the double-digit growth demonstrated by gasoil and gasoline with demand for both fuels surpassing peak demand levels of pre-pandemic times. While gasoil demand has grown by 12%, gasoline has grown back at 13% on Y-o-Y basis.

Despite the slowdown concerns of previous year, both state-owned oil marketing companies and private players have continued expanding their network, adding over 4,000 outlets in FY 2022-23, and taking the total number of retail outlets in India to over 90,000.

Buoyant economic activity in the country, consistent growth in 2w and 4w sales, continued enhancement of road infrastructure and increase in retail outlet network augurs well for maintaining the momentum in transportation fuels demand growth in the country over the coming decade.

The Electric Vehicle market in India scaled up significantly in FY 2022-23 with 6,600+ charging stations and cumulative country-wide EV’s of 2.7 Mn.

Building on the steady growth shown largely on back of domestic travel, Aviation industry has grown by more than 47% in FY 2022-23. This is on the back of unleashing of pent-up travel demand both within India and outside due to lockdown concerns over the last few years. That the growth is coming despite churn and consolidation amongst the airline players augurs well for sustained growth of Indian Aviation sector.

INDIA FUEL CONSUMPTION TREND (EXIT QUARTER TREND)

(MMT)

Margins

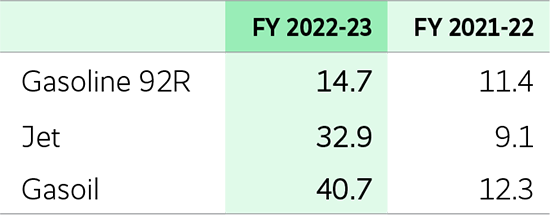

Gasoline margins rose to $14.7/ bbl in FY 2022-23 from $11.4/bbl in FY 2021-22 backed by steady demand growth and improving mobility. The recovery of transport demand post Covid partially offset demand loss due to high fuel prices. Limited exports from China also supported gasoline cracks.

Gasoil margins rose sharply to $40.7/ bbl in FY 2022-23 from $12.3/bbl in FY 2021-22 amid strong global demand growth on rising economic activity. Also, uncertainties around Russian diesel supply due to EU embargo on Russian products, gas to oil switching and low global inventories kept gasoil margins strong during the year.

Jet fuel cracks rose to $32.9/bbl in FY 2022-23 from $9.1/bbl in FY 2021-22. Jet fuel margins increased on support of steady demand growth and strong gasoil margins.

ASIAN CRACKS FOR TRANSPORTATION FUELS

($/BBL)

Source: Platts

Polymers and Elastomers

Global Market Environment

Global polymer demand in CY 2022 was stable at 245 MMT on Y-o-Y basis. Global polyethylene (PE) demand grew by 0.3%, polypropylene (PP) demand remained flat, while PVC demand contracted by 3.4% in CY 2022. Growth in global demand for Styrene Butadiene Rubber (E-SBR) was 4% and Polybutadiene Rubber (PBR) was 2% in FY 2022-23 on the back of automotive sector demand.

Global Cracker Operations: Global Ethylene demand increased by 2% Y-o-Y to 183 MMT in CY 2022 against 8% Y-o-Y growth in CY2021. New capacity addition of 10 MMTA in CY2022 resulted in lower operating rates at 85% compared to 86% in CY2021.

Ethane and Naphtha Prices: US Ethane average prices increased by 27% Y-o-Y from 35 cpg to 44 cpg in FY 2022-23, led by higher Natural gas prices. Naphtha average prices in Asia were down by 3% Y-o-Y from $718/MT to $696/MT, due to lower demand from Petrochemicals.

Domestic Market Environment

PP domestic market demand grew by 6% on Y-o-Y basis on account of healthy demand from health & hygiene sector and Biaxially Oriented Polypropylene (BOPP) packaging. PE demand registered 8% growth Y-o-Y basis majorly driven by pipes, insulation, e-commerce, FMCG and liquid packaging. PVC demand grew by 32% Y-o-Y, driven by growth in construction activities and policy boost for several water and sewage pipeline projects.

Indian PBR market grew by 7% Y-o-Y, while SBR market declined by 1%.

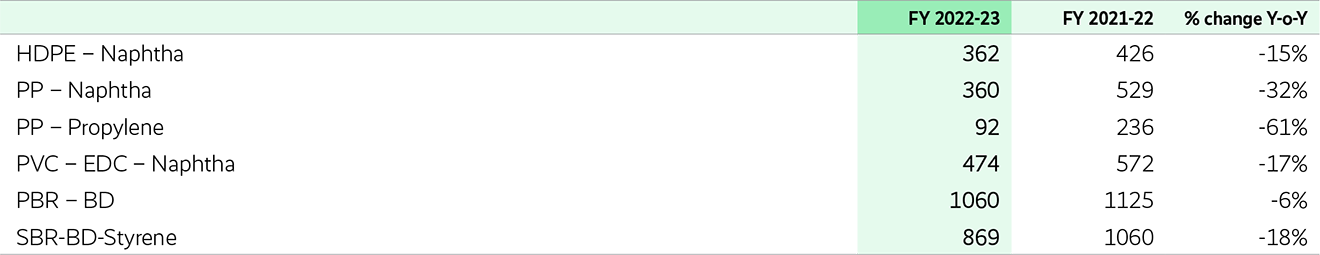

Margins

Polymer prices weakened during FY 2022-23 amidst lower demand from China due to COVID related restrictions including recessionary concerns in major developed markets. Global operating rate for PP, PE and PVC averaged 81%, 83% and 79% respectively during CY2022, lower than CY2021. Polymer margins weakened during the year as product prices declined more than feedstock prices. Integrated PP-Naphtha, HDPENaphtha and PVC margins contracted by 32%, 15% and 17% respectively during the year.

Intermediates and Polyesters

Global Market Environment

Global demand for intermediates (PX/PTA/MEG) increased marginally by 1% to 159 MMT in CY 2022 from 157 MMT in CY 2021, as markets remained under pressure due to volatility in crude prices, high energy costs and weak demand in China. PX demand grew marginally by 2% while supply remained tight due to production cut by few PX producers amidst unfavorable economics. PTA demand marginally reduced by 1% to 75 MMT in CY2022 due to high inventory of Polyester products in China and weak downstream demand. MEG witnessed flat demand at 33 MMT in CY2022. MEG operating rates dropped from 66% to 58% in CY2022 with higher capacity additions.

Polyester overall global demand remained flat at 85 MMT in CY2022 amid inflationary concerns. Global polyester markets were under pressure as demand weakened in China due to Covid related restrictions. Western markets too witnessed lacklustre demand on account of high inflation and slowdown in economic activities.

SOUTHEAST ASIA POLYMER MARGINS

(US$/MT)

Source: Platts, ICIS

Domestic Market Environment

Intermediates demand improved by 4% on account of continued recovery in textile and polyester demand. Overall Polyester demand grew by 14% in FY 2022-23. PET witnessed strong growth of 28% followed by PSF 17% and PFY 10%. Demand revived strongly on account of resumption of normalcy in schools, offices, festive and marriage related celebrations and increase in tourism activity post removal of Covid related restrictions. High cotton prices aided usage conversion from cotton to polyester globally.

PET margins were supported by strong demand in packaged drinking water segment. Filament and Staple margins were severely affected due to energy crisis, high inflation in EU and US markets and poor retail demand in China.

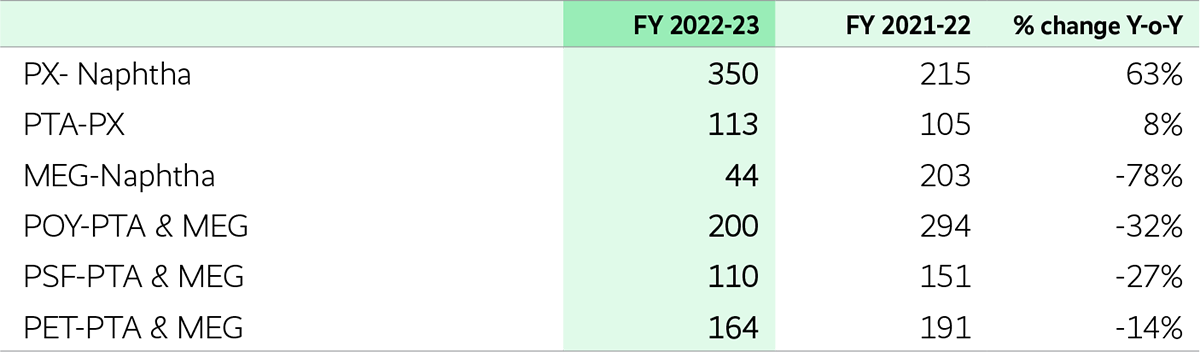

INTERMEDIATES AND POLYESTER MARGIN TRENDS

(US$/MT)

Source: China/North East Asia prices as per Platts, ICIS, CCF Group, RM-PTA & MEG

Margins

In FY 2022-23, PX prices improved by 16%, while PX-Naphtha margins surged by 63% surpassing the 5-year average of $303/MT. Integrated producers continued to optimise production based on PX vs. Gasoline economics.

PTA market in China was impacted due to weak downstream demand. PTA producers responded by moderating operating rates and keeping check on inventory levels. PTA prices registered gain of 15%, while PTA-PX margins improved by 8%.

MEG margins were under pressure as inventory remained high due to weak downstream demand and high energy cost. MEG-Naphtha margins reduced significantly by 78% as the MEG prices dropped by 22% while Naphtha prices remained firm.

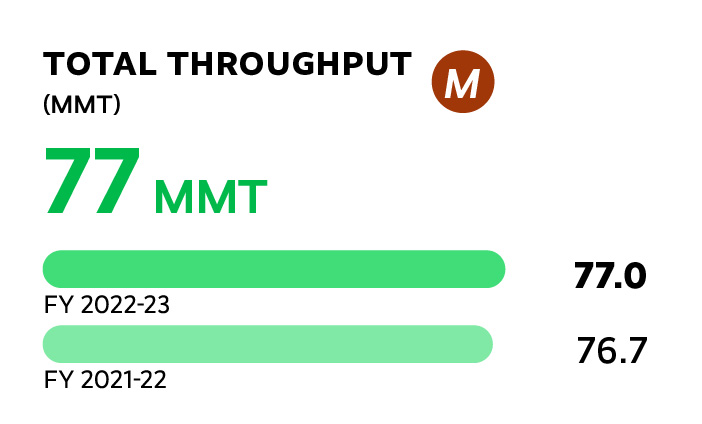

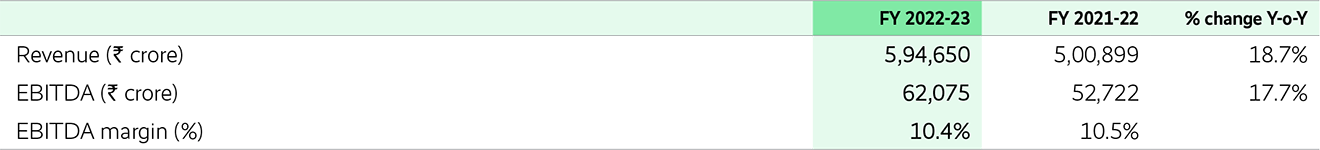

PERFORMANCE UPDATE

O2C EBITDA was at record high with strong fuel cracks and competitive feedstock sourcing aided performance. Introduction of SAED on transportation fuels impacted full year earnings by `6,648 crore. Highest ever domestic sales for Polymers, Elastomers and PET supported realisation, favourable domestic demand environment and ethane cracking economics supported profitability.

Read moreBUSINESS PERFORMANCE

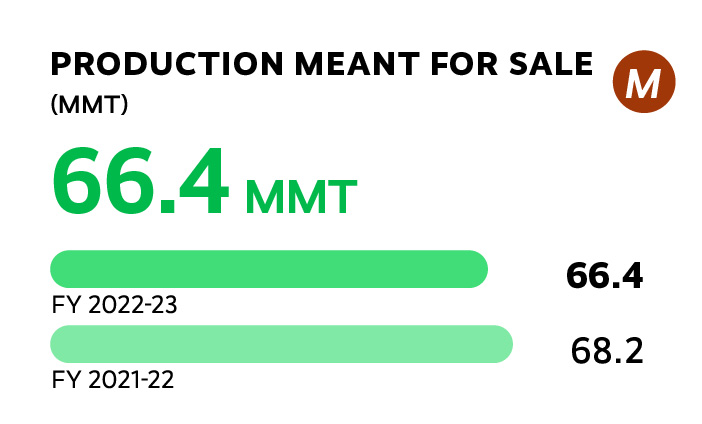

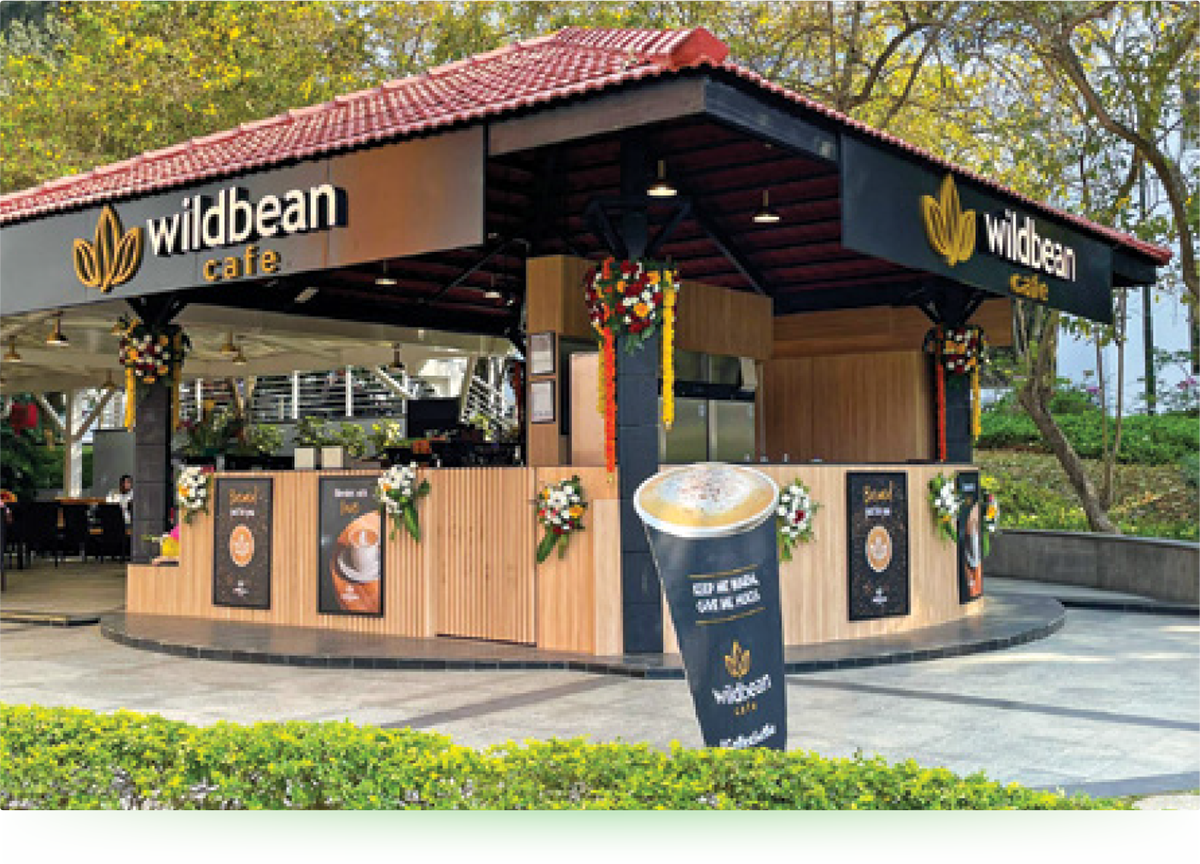

PRODUCTION MEANT FOR SALE

(in MMT)

Transportation Fuels

In FY 2022-23, RIL remained among the largest producers of transportation fuels, exporting 36.1 MMT of products across the globe.

RIL can also produce a large variety of grades to meet international market requirements of Europeans countries, Africa, East Asia and Australia. The Company is well recognised as a trusted supplier of high-quality transportation fuels with zero cases of quality and quantity disputes. RIL has a cost advantage as it operates through one of the most modern and efficient ports – Jamnagar. The Company marketed 10.7 MMT of products in the domestic market in FY 2022-23.

On the back of industry defining value propositions, RIL is building on its intra-city presence to complement its strong highway presence. RIL launched first ever country-wide national scheme to further augment gasoline sales. It is also working at creating the best-in-class experience for gasoil customers. With improved delivery in on-demand fueling, RIL is reinforcing the value proposition for fleet and non-transport/off-road segment.

On the backdrop of growth in retail outlet network, further improvement in Quality and Quantity (Q&Q) and best-in-class technology, RIL is well placed to help stimulate the continued transportation fuel growth in the country.

0 MMT

FUEL PRODUCTS EXPORTED GLOBALLYHSD B2B Business

In FY 2022-23, RIL market share in HSD B2B business increased from 9.4% to 11%. While industry de-growth was 48% in the year, RIL registered only 39% de-growth on Y-o-Y basis.

Adapting to evolving market scenario RIL’s O2C business continued to increase footprint across segments and geographies in both private and government sectors. Building on strong customer connect, the business saw a significant increase in the marine bunkering segment by 52%.

RIL has further strengthened position as supplier of choice in infrastructure and mining, contributing to India’s continued growth.

0 %

INCREASE IN MARINE BUNKERING SEGMENTFuel Retail Business

Reliance BP Mobility Limited (RBML), operating under brand Jio-bp, a 51:49 joint venture of RIL and bp, with a network presence of 1,561 outlets continued investing in incubating and growing network footprint of industry leading propositions.

With the development of bespoke additives after multi-year research using Indian fuel, Indian engines and simulated Indian conditions, the company is set to elevate both diesel and petrol standards of India. To take the product to every single customer, Jio-bp has constructed curated automated dosing infrastructure across its country-wide supply network and built country-wide additive supply chain from scratch.

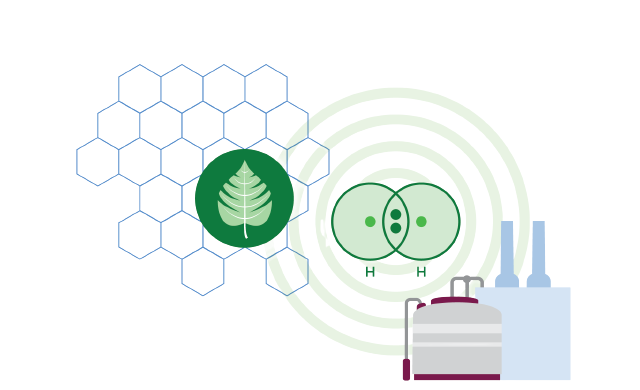

Building on the convenience proposition, Jio-bp has commissioned World’s first Wild Bean Café outside fuel forecourt to strengthen brand recall and complement their electric charging offering.

Continuing its pioneering work in reducing industry pilferage and encouraging safe practice, Jio-bp, operating under Jio-bp fuel4u, has received patent for technology enabled tamper proof HDPE containers used for transporting diesel. Built in-house, the container is testimony to continued innovation to redefine the range of retail outlet. Today, with ~100 mobile dispensing units and recently approved HDPE packed containers, Jio-bp supports the functioning of mobile towers, agriculture, hospitals, and remote mines alongside ensuring continued fuel delivery in the event of calamities in remote areas.

In its quest to offer low carbon solutions, Jio-bp has forayed into CNG retailing and continues to tie-up with CGD players across the country. In line with the Government of India’s vision, the company was amongst the first OMCs to launch E20 fuel and has also commissioned its first Compressed Biogas retailing facility.

0+

RETAIL OUTLETSAviation Turbine Fuel (ATF) Business

With the domestic aviation industry growing steadily, Jio-bp (operating under Air bp-Jio) has registered a growth of 35% in direct sales volume, staying ahead of the competition and reinforcing customer trust. Foray into key markets of Mumbai and Delhi have ensured strong volume growth prospects with scheduled airlines. Sustained technology leadership to improve service levels and achieve operational excellence has ensured multiple public awards (including Best Service Provider by Assocham & Ministry of Civil Aviation; bp International Award for Operations and Technology) for Air bp-Jio in FY 2022-23.

Downstream Chemicals

RIL maintained steady polymer production with reliable operations across sites. It maintained operating rates higher than its peers based on the market scenario by leveraging global supply chain. This was achieved by leveraging high level of integration from feedstock to finished goods, strong global business networks, multi-modal logistics capabilities and enhanced digital capability with all stakeholders in the value chain. RIL maintained its market share in both polymer and polyester market. As RIL continued to explore new products and market segments, the integrated O2C business model helps optimise feedstock to run downstream plants at full capacity.

Polymer domestic demand is expected to be strong, driven mainly by growth in e-commerce, packaging, durables, auto and infrastructure segments. Strong demand likely to continue for Pipe sectors backed by infrastructure projects.

STRATEGIC PRIORITIES AND WAY FORWARD

Diversified Feedstock Sourcing, Minimising Feedstock Cost

- Long term contract for timely EDC imports to ensure zero loss in productivity.

- Feed flexibility in CDUs with debottlenecking of lighters+naphtha handling capability.

- Feed flexibility in FCC with upgradation of flue gas desulfurisation capability.

- Increase EDC production and reduce import dependence.

- Maximise Ethane sourcing to optimise feedstock cost.

Improved Product Netbacks with Wider Market Reach and Quality Upgrade

- Integrate Polyester assets of Shubhalakshmi Group to augment RIL polyester product portfolio.

- Implementation of naphtha quality upgrade for improved product placement flexibility and netbacks.

- PVC downstream processors tie up across the business value chain.

- Strengthening product portfolio with new grade development to support domestic sales.

- Increase PP sales to promote valueadded exports of Woven Sacks and FIBCs by RIL downstream customer.

- Leverage Butadiene sourcing for uninterrupted elastomer production.

- Plan to service nearby EO customers through pipeline for increased sales and safe transportation.

Asset Sweating and Operating Cost Minimisation

- Implementation of various Performance Improvement Options (PIOs) for energy conservation in Gasification.

- In-house development of speciality grade PP and LDPE catalyst for cost optimisation.

- Low-cost debottlenecking of existing assets for petrochemical capacity enhancement.

- In-house technology development for O2C transition, sustaining market advantage.

Digital Transformation

- Digital Twin development Proof of Concept (POC) completed for analysing and predicting plant performance.

- Evaluation of application for early event detection/ prediction of failures to minimise unplanned downtime.

- Use of AI/ML for predictive business analytics over conventional processes and systems to track and predict future global business trends.

- Platform development for Planning & Optimisation and Trading.

- Development of Network operation center for real time information of O2C business operation.

Supply Chain Management

- Real-time automated order servicing and agile inventory management system for enhanced customer experience.

- Establishment of end-to-end Supply Chain Control Tower for operational visibility and disruption management.

- Increase use of multi modal movement , explore transportation with alternative fuels and integration with GoI ULIP (Unified Logistics Interface Platform) for reducing overall carbon emissions.

Sustainability and Transition to Net Carbon Zero

- Successful trial of green hydrogen production with torrefied biomass firing in Gasifier.

- Increased Biomass firing in CFBs.

- Commissioning of new Toll manufacturing plant at Andhra Pradesh and ramping up recycling capacity to 5 billion bottles per year.

- To set up commercial plants of 25 TPD and scale up the chemical recycling technology to promote plastic circularity. Process the pyrolysis oil produced at our processing units to produce circular polymers.

- Develop green polyolefin product portfolio and ramping up capacities to deliver application specific green products.

- Develop ReRoute™ as the preferred choice of customers for waste to road product and ramping up capacities by on boarding vendors and dealers across India.

- Transition plan for renewable power from fossil fuel-based power.

- Evaluation of technologies for Bio-diesel and SAF production.

Domestic Transportation Fuel Sales Push through Jio-bp

- Reinforce fleet management program to consolidate position in highway segment.

- Grow network of mobile dispensing units (MDU) and packed fuel containers (PFC).

- Leverage technology and expedite rollout to sustain market leadership in mobile fuelling.

- Network-wide rebranding exercise for existing outlets, AFS and tanktrucks.

- Launch additivated Fuel offering followed by country wide brand launch.

- Expedite network footprint of all new customer value propositions launched.

Strengthen Presence into Low Carbon Fuels (EV Charging and CNG)

- Continue to tie-up with demand aggregators, technology providers and OEMs.

- Strengthen dosing infrastructure and country-wide additive supply chain.

- Ramp-up country wide footprint of EV charging network.

- Evolve technologies and operating model to stay abreast with the EV industry.

- Continue tie-up with leading gas distributors for country-wide availability and strengthening existing network.

R|Elan™ and Circular Economy Update

Launched bio-mimic

biodegradable R|Elan™

Fabrics 2.0

R|Elan™ ECOGOLD with CICLO®

collection created by Gauri and

Nainika

The 10th season of R|Elan™ at the Lakme Fashion Week (LFW) at Jio World Convention Centre in Mumbai was a momentous occasion for the brand as it witnessed the launch of the most innovative fabric on the runway, R|Elan™ EcoGold with CiClO®. The special technology infused in the fabric makes it bio-mimic biodegradation process and hence a potential solution to reduce the cycle of waste accumulation in landfills, soil, wastewater, and oceans.

With this season at LFW, R|Elan™ accomplished 5 successful years of participating, collaborating and contributing at India’s largest fashion event while pioneering and creating awareness about the importance of sustainability and circularity in fashion. For this edition R|Elan™ collaborated with the designer duo Gauri & Nainika who used sustainable fabrics R|Elan™ GreenGold, made entirely out of 100% post-consumer used PET bottles and R|Elan™ EcoGold with CiClO® together with an aesthetic variant, R|Elan™ FreeFlow to create their stunning collection, ‘Midnight Botanica 2023’.

'Midnight Botanica 2023' collection had a rich, dark, dreamy look with stark contrasting hues of the night and botanical inspirations. Floating fashionably down the ramp were light-as-air chiffons, crepes and organzas that were turned into swirling dresses, jumpsuits and red-carpet-worthy flowing Grecian gowns. The romantic colours set the mood for the collection as fiery red and delicate ivory were merged skilfully with strong jewel tones. The spring-summer R|Elan™ EcoGold line by Gauri and Nainika’s collection was inspired by Grecian lines and incorporated styles that were inclusive and generous and warm and designed to flatter all body types.

Working with R|Elan™ fabrics enabled the designers to create a special sustainable collection, contributing to the ‘green fashion’ movement worldwide.

EarthTee 4.0

As a brand championing sustainability through fashion, R|Elan™ launched EarthTee 4.0 to continue creating awareness about the importance of circularity with the aid of fashion. R|Elan™ EarthTee is made from R|Elan™ GreenGold – 100% post-consumer PET bottles collected from FDCI X Lakme Fashion Week’22. These EarthTees are shared with various influencers and celebrities to amplify the power of sustainable fashion and inspire consumers to adopt sustainability and circularity as their lifestyle.

Circular Design Challenge

Circular Design Challenge has emerged as India’s largest platform that incentivises and awards fashion & design entrepreneurs working in circular fashion to find scalable solutions for waste reduction in the fashion and textile industry.

R|Elan™ Fashion for Earth, ‘Circular Design Challenge' Season 4 winner ‘Pieux’ brings sustainable fashion on the ramp in 2022

Winner of the R|Elan™ Circular Design Challenge Season 4 in Partnership with the United Nations in India, at the Lakmé Fashion Week X FDCI during the March 2022 edition, ‘Pieux’ by Pratyush Kumar brought a great sustainable fashion experience on the ramp. The award-winning collection made use of deconstructed and reconstructed old clothes, that infused more life into the garments. Inspired by the incredible world of life under the microscope, Pieux showcased the theme “Illusion” in their collection at the event.

When it came to the foundation of the collection, the brand opted for materials like CARTEX (100% Upcycled carpet waste handloom textile), R|Elan™ GreenGold (100% Recycled polyester made from postconsumer PET Bottles), R|Elan™ GreenGold + R|Elan™ FeelFresh Fusion Fabric (100% Recycled Polyester with added anti-microbial properties), GRS certified recycled nylon, GRS certified recycled Polyester and organic cotton to create garments as well as footwear. Fashion that is faithful and concerned about the environment has a lasting effect on the trend charts and the “Illusion” collection by Pieux was the ideal offering for buyers whose thoughts are on the right sustainable path. Warina Hussain, the showstopper of the collection on the runway applauded the initiatives by R|Elan™ and Pieux.

New Innovative Fabric Launch R|Elan™ Cotluk – A fabric that is smarter than cotton

Cotton has been a key raw material for the textile industry. Though the textile industry faces some major challenges such as low productivity and volatile price fluctuations when they use cotton as a raw material. The impact of wide price fluctuations has its negative impact on both – the textile value chain and the end consumers. RIL, with its extensive R&D, has developed a smarter alternative to cotton by introducing R|Elan™ Cotluk fabric. With volatility in cotton availability, it is extremely important to have a superior alternative with cotton-like attributes. R|Elan™ Cotluk, offers cotton-like look and feel, becomes an apt alternative as it is a perfect material for making high-quality knits and woven apparel across categories like Casual Knits, Denims, Formal wear etc. R|Elan™ Cotluk also has superior features like excellent strength, durability and easy care.

Empowering the Green Fashion Revolution

Keeping in mind the ever-increasing demand from consumers for sustainable products, R|Elan™ Cotluk is also made available from recycling 100% post-consumer used PET bottles as R|Elan™ GreenGold Cotluk. Cotluk is also available for the home textile category under the brand name Recron® Cotluk that can be used across varied applications like Bedsheets, Cushion Covers, Curtains, Towels, etc. Thus, R|Elan™ keeps its promise by consistently offering smart fabric solutions using extensive technical knowhow and cutting-edge technology.

Industry Recognition and Accolades

RIL was recognised for its continuous efforts to develop state-of-the-art digital capabilities and ensure customer delight for sustained business growth.

RIL was recognised by industry forum, Chemical and Petrochemical Awards 2022 under the 'DigiTech Front Runner of the Year' category on November 2,2022 at India Chem organised by the Ministry of Chemicals and Fertilisers, and FICCI.

This award acknowledges RIL leadership in continuously implementing and adopting new technologies for sustained business growth.

Platform Push for Jio-bp

- Transitioning to a complete platform organisation for facilitating seamless growth.

- In New Retail Outlet Monitoring, to centrally monitor work at 1,000+ operating sites.

- In Battery Swap and Fixed Charging, to rapidly seed customers in high growth vertical.

- In Mobile Fueling, to ensure 100% digital transaction for seamless on-demand doorstep fuel delivery.

- In Loyalty, to build country’s largest integrated coalition program.

Industry 4.0 Deployment SUSTAINABILITY for Process Efficiency at Jio-bp

- Facial recognition based Manpower management for centralised Driveway Sales Man (DSM) control

- Drone technology for cost and time efficient demand assessment for new outlet

- Remote Monitoring for centralised HSSE compliance at far-off project sites

- IoT for proactive maintenance of all critical forecourt assets. E.g., DG set, Dispenser

Enhancement of Existing Digital Platforms

Planning and Optimisation (P&O)

Consolidation of inputs from multiple sources and stake holders to facilitate the Planning and Optimisation (P&O) team to run the weekly/monthly rolling plans based on changing market conditions.

Business Operation Centre

Role/Team based data driven performance management system with built in analytics for business service delivery for profitable product placement, cost distribution & supply chain and top-notch customer service.

Operations and Chartering

- Automation of Clean Freight Forward Assessments based on market data.

- Vessel Management Platform: Automation of Time Chartered Vessel Reporting Data for freight cost optimisation.

- Digitisation of claim process from trigger to settlement.

- Extension of workflow-based BOC (Business Operations Centre) Platform for Chartering, Operations and Settlement.

Sales and Service

- Customer First Platform: Personalised experience for customers and channel partners, on device agnostic open-source technology including easy and secure onboarding, Product cart management, Order and Contract Management, Credit Management, Payments and settlement, visibility of dispatch plan and location tracking of consignment along with desired analytics. Also services like B2B integration with customer for billing, delivery and customer payment systems. WhatsApp Chatbot for customer, is under beta testing.

- Jio CRM Platform: Customer service management for Reliance Sales Force for active customer engagement and service.

- Product branding for new materials: Dynamic Websites including self-service content management systems for new Materials like HexaRel, RelWood, Relinforce, Tuffrel have been developed.

Data Management Platform to Deliver Data Products

During this year Reliance progressed in configuring and adopting the enterprise data platform and data management architecture to unlock data from source systems and create data pipelines. These include performing end-to-end data management activities from ingestion, and contextualisation to creating data models and consumable datasets.

SUSTAINABILITY

Phthalate free catalyst

established at JMD Polypropylene (PP) for high growth Health & Hygiene and Biaxially oriented polypropylene film (BOPP) grade.

Commercialised sustainable

packaging solutions for non-food

and

non-pharma applications and

biodegradable recycled polyester.

Jio-bp received Patent for

inhouse developed HDPE packed

container for

on-demand doorstep

delivery of Diesel.

First ever green hydrogen production achieved with successful firing of torrefied biomass in Gasifiers.

Continued focus on innovation,

development of technology and sustainable products for recycled polyesters and polyolefins.

Biomass firing in Coal Fired Boilers (CFBs) at petrochemical sites increased to >11wt% of total feed as a part of transition plan to achieve net carbon zero targets.

Ethanol blending in Motor Spirit (EBMS) facility commissioned.

CASE STUDY

Drone Based Demand Assessment. Creating New Normal

Taking accurate data in remote highways for demand assessment of new retail outlets is time consuming, costly and error prone process. Through drone technology in partnership with Asteria, RIL has found a innovative solution at a fraction of cost and time with close to 100% data accuracy. The project was recently awarded as Geospatial Awards 2022.

CASE STUDY

ADF Facility – Making a New Start

100% additivated fuel is the heart of RIL retail fuel offering. To facilitate that RIL has created unique independent facility adding a new name – Automated Dosing Facility – to Indian petroleum industry. Manned by only a handful of resources these sites constructed at the cost of low end retail outlets is a testimony of technological brilliance. This is ensuring every single drop of RIL oil is additivated even if it is coming through hospitality location.

CASE STUDY

Remote Monitoring – Eye in the Sky

Technology can help surmount the biggest of operational challenges, if used innovatively. Through smart CCTV, RIL has deployed remote monitoring system which automatically alerts employee / workers if they are not compliant with service or HSSE SOP at operating or under construction site respectively.

CASE STUDY

Creation of Mobility Bouquet for Corporates

With a portfolio of low carbon fuels (including CNG, BioCNG, EV and differentiated fuel) and convenience solutions (under Wild Bean Café – WBC), Jio-bp is helping the leading majors in IT, FMCG and Auto sector. Their unique fuel portfolio reduces supply chain carbon footprint of these majors and brand recall of WBC gets new motorists to Jio-bp fuel forecourt. This is a first-of-itskind corporate-mobility solution provider partnership in India.

CASE STUDY

Aviation: Technology Driven Excellence

With demand dip during the pandemic condition, RIL invested in upgrading technology at AFS stations. Alongside receiving awards at national and International forum, RIL has been growing much faster than industry after demand takeoff. Building trust through technology driven assured quality and transaction clarity helped RIL strengthen relationship with airline partners.

CASE STUDY

The Rise and Rise of Jio-bp Pulse

Aligned with government’s vision to provide green mobility solutions and inspired by parent companies (RIL and bp) target to be Net Carbon Zero Jio-bp Pulse has grown strongly building upon the sizeable Indian growth in both parc and public awareness for EV.

Widest

Operating under the brand Jio-bp Pulse, Jio-bp has added over 1,000+ public charge points in FY 2022-23, taking their network strength to 1,400+ across 8 cities and major highways. Expected to grow multifold again in FY 2023-24.

Curated

Includes seven of country’s largest charging hubs (100+ charge points) with dozens other hubs under construction. Also, built facility at malls, public parking place, work place and residential areas. One stop solution of entire set of offerings.

Safest

Adhering to global best practices, deployment of high-quality & compliant hardware and digital systems to ensure complete peace of mind for customers.

Differentiated

Future ready fast charging network to match charging requirements in rapidly growing battery capacity and size in upcoming Electric Vehicles.

Tech Led

Quality digital experience through state-of-the-art platform; Jio-bp offers feature-rich, scalable, and modular mobile app for seamless charging journey of users.

Integrated

Partnering with major retail estate players, OEMs, technology providers, demand aggregators and other stakeholders across EV value chain to strengthen the entire ecosystem.

Backed by widest, curated, safest, differentiated, tech led and integrated network, Jio-bp Pulse is on path to be the leading Charge Point Operator in the country.

OUTLOOK

Oil Demand is expected to remain healthy on the back of steady economic growth. New supply from upcoming refining capacities in Middle East, China and Africa will likely keep the market balanced. Oil price and product cracks to remain firm as global trade realigns in the aftermath of Russia Ukraine conflict. Relaxation in Chinese Zero Covid Policy is expected to boost China demand. Trade flows are likely to improve with easing out of supply chain disruptions. Polymer domestic demand is expected to be strong, driven mainly by growth in e-commerce, packaging, durables, auto and infrastructure segments. Strong demand likely to continue for Pipe sectors backed by infrastructure projects.

Abbreviations

Manufactured

Capital

Manufactured

Capital