Reliance’s strong governance framework enables it to navigate the complexities of a dynamic business environment while upholding the highest standards of corporate citizenship. The Company’s commitment to accountability, integrity and transparency guides every decision, from strategic planning to daily operations.

Reliance’s leadership is guided by a diverse and experienced 14-member Board, ensuring strategic direction and effective governance. Each member brings unique expertise, skills and experience across diverse industries, strengthening the Board’s collective decision-making process.

For information on the Board composition and diversity, kindly refer PG 46 ) of the report.

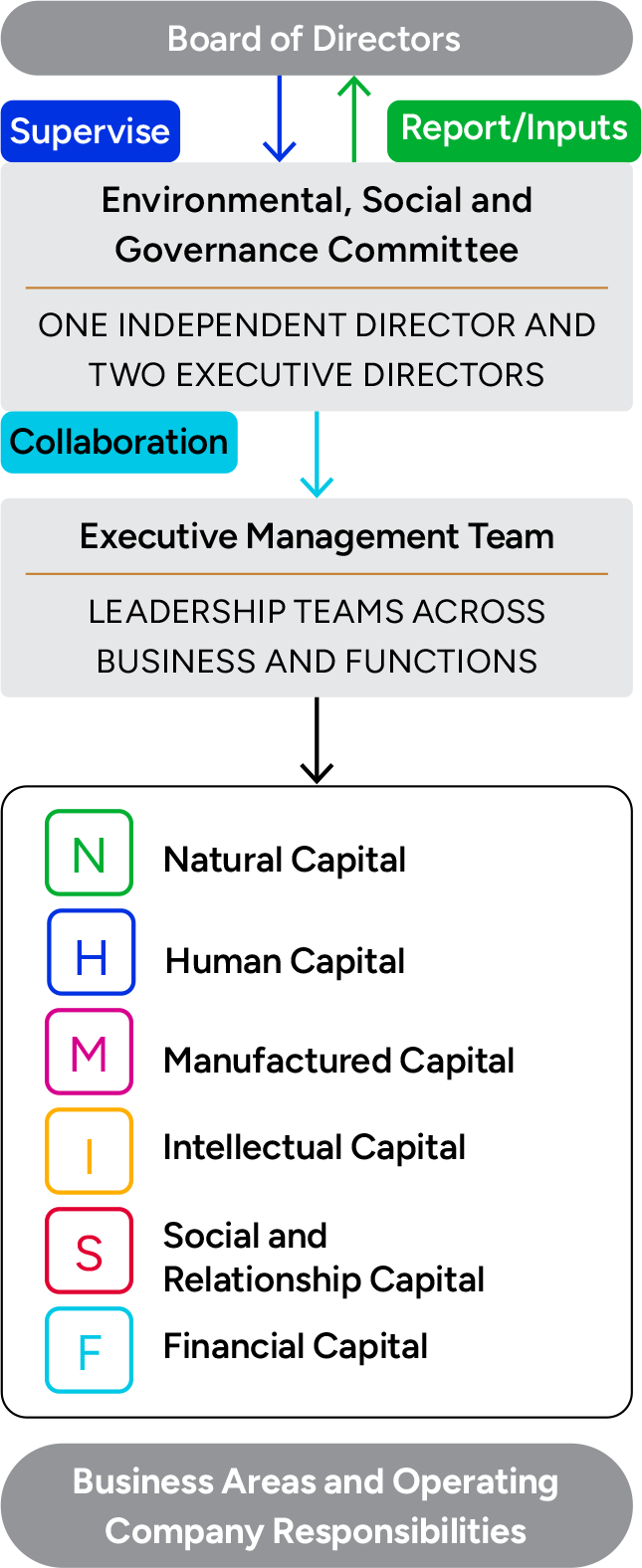

Reliance ensures effective ESG management through transparent and accountable oversight by dedicated Board Committees, each focusing on specific ESG aspects. These committees include a dedicated ESG Committee, Audit Committee, Corporate Social Responsibility and Governance Committee, Stakeholders Relationship Committee and Risk Management Committee.

Reliance’s Board of Directors provides strategic direction and oversight for the Company’s approach to ESG related issues including climate change. Their governance framework establishes a structured process for developing and implementing a comprehensive sustainability agenda, ensuring effective decision-making in this critical area.

Reliance’s ESG Committee shapes and guides the Company’s sustainability agenda. It leads efforts to define goals, monitor performance, engage with stakeholders, and identify key ESG issues and opportunities. The ESG Committee, comprising two executive directors and one independent director, provides strategic guidance on sustainability and oversees key initiatives. The status of ESG activities is periodically reviewed by both the ESG Committee and the Board of Directors.

In collaboration with other Board Committees, the ESG Committee monitors ESG-related risks and implements mitigation strategies, and advises the Board on international sustainability practices. Guided by its Terms of Reference, the Committee prioritised strategically and operationally significant areas for Reliance in FY 2024-25, ensuring effective oversight of safety and operational risk, environmental impact, climate change, and overall sustainability.

For more details on the Committee’s Terms of Reference, please refer to: https://www.ril.com/about/boardcommittees.

For information on the committee’s composition and meetings, please refer PG 55 ) of the report.

Reliance’s commitment to its stakeholders is embedded within a robust framework of policies and a comprehensive Code of Conduct. These guiding principles, embraced by both employees and Directors, ensure ethical operations and legal compliance. Reflecting Reliance’s core values—Customer Value, Ownership Mindset, Respect, Integrity, One Team and Excellence—the Code serves as a compass for decision-making. Reliance’s Senior Management and Directors annually affirm their commitment to upholding these principles.

Read RIL’s ESG policies here:

https://

www.ril.com/investors/shareholdersinformation/policies

Reliance believes in healthy competition,

driven by superior product and service

quality, competitive pricing and a strong

focus on sustainability. The Company

is committed to fair and ethical

interactions with competitors, ensuring

that competitive insights are obtained

responsibly through transparent and

lawful means. Furthermore, Reliance

ensures that all employees are well-versed in and adhere to the principles

of competition law. No new cases of

unfair trade practices or anti-competitive

behaviour were recorded in

FY 2024‑25.

Reliance maintains transparent engagement channels to understand and address stakeholder concerns and seek their inputs, fostering mutually beneficial relationships. This approach allows the Company to incorporate stakeholder perspectives into its decision-making processes, building trust and promoting shared value creation.

For more details on the Company’s stakeholder engagement, please refer Principle 4 of the BRSR Report.

Reliance identifies material ESG topics through active stakeholder engagement, gaining insights into key concerns and priorities. These inputs help determine the most significant ESG factors impacting the Company’s business and its stakeholders, which in turn inform comprehensive risk and opportunity assessments, enabling proactive responses to challenges and emerging trends.

Reliance periodically evaluates its material topics through ongoing stakeholder engagement and materiality assessments. In FY 2021-22, the Company conducted a detailed materiality assessment, analysing potential issues based on inputs from both internal and external stakeholders. These findings were reviewed and approved by the Executive Board to ensure alignment with the Company’s objectives. In addition, Reliance also adopted a “Double Materiality” approach, to assess the material impacts on the Company and its impact on environment and social parameters.

More details about the double materiality approach and prioritisation of material topics can be found on page 164 of the Integrated Annual Report 2022-23.

Reliance’s Material Topics

| 1 |

Climate Change Read More |

|

| 2 |

Managing Environmental Impacts Read More |

|

| 3 |

Energy Efficiency of Operations Read More |

|

| 4 |

Water and Effluent Management Read More |

|

| 5 |

Raw Material Security Read More |

|

| 6 |

Ecosystem and Biodiversity Read More |

|

| 7 |

Innovation and Technology Read More |

|

| 8 |

Waste Management and Circular Economy Read More |

|

| 9 |

Sustainable Supply Chain Management Read More |

|

| 10 |

Disaster Preparedness and Management Read More |

|

| 11 |

Health, Safety and Employee Well-being Read More |

|

| 12 |

Diversity and Inclusion Read More |

|

| 13 |

Customer Satisfaction Read More |

|

| 14 |

Data Privacy and Cybersecurity Read More |

|

| 15 |

Security and Asset Management Read More |

|

| 16 |

Talent Management Read More |

|

| 17 |

Community DevelopmentRead More |

|

| 18 |

Labour Management Read More |

|

| 19 |

Human Rights Read More |

|

| 20 |

Business Ethics, Integrity and Transparency Read More |

|

| 21 |

Regulatory Issues and Compliance Read More |

|

| 22 |

Grievance Redressal Mechanisms Read More |

|

| 23 |

Risk Management Read More |

|

| 24 |

Economic Performance Read More |

|

| 25 |

Code of Conduct Read More |

|

Natural

Capital

Natural

Capital

Human

Capital

Human

Capital

Manufactured Capital

Manufactured Capital

Intellectual Capital

Intellectual Capital

Financial

Capital

Financial

Capital

Social

and Relationship Capital

Social

and Relationship Capital

Risk

Management

Risk

Management

Governance

Governance